IBANK, EPM, BPM, OBIEE, HYPERION, OFSAA

- 1. <Insert Picture Here> “High Performing Financial Institutions and the Keys to Success in an Uncertain Environment”

- 2. 2 Presentation to the Caribbean Association of Indigenous Banks by Peter Hill, Oracle Financial Services Software “High Performing Financial Institutions and the Keys to Success in an uncertain Environment” The liquidity crisis Increasing scrutiny by regulators The importance of bringing Risk and Finance into decision making We describe this as the ‘New Normal’We describe this as the ‘New Normal’

- 3. 3 “New Normal” in Financial Services Transformation Unfolding Now • Sound risk management must now be embedded in all decision making processes across the institution • Risk and performance management, along with accounting functions, must naturally exist within a common decision making platform • Compliance with advancing and more complex regulatory mandates will trigger a shift in focus from paper pushing/reporting driven efforts to competitive driver • Capital adequacy and liquidity risk management will define an institutions’ ability to not only survive, but thrive, in the “New Normal” marketplace

- 4. 4 “New Normal” in Financial Services This Transformation Means… • Operational Risk must play a more prominent and integrated role at the top of the institution to identify, control and manage risk and performance issues • Financial crime and compliance strategies are already moving from pure regulatory compliance plays to strategic with increased need for integrated with other risk systems • CIOs must revisit the nature of supporting data warehouse architecture strategies as cross functional needs drive major change and restructuring • Collection and distribution focused data strategies will transform into more purpose-built and end use case approaches

- 5. 5 Ever-Changing Compliance is a Big Issue 6© 2010 Oracle Corporation – Proprietary and Confidential

- 6. 6 Banks Face Many Different Types of Risks Trading & Model Risks Business Continuity Legal Risks Outsourced and Supplier Risks Compliance Risks Financial Crime (AML, Fraud, Rogue Trading) Product Risks Market Risk IT Governance and Information Security Documentation Risks Reputational Risks Risks need to be identified and evaluated. What controls are in place? Do they work? What happens in stress scenarios? Credit Risk

- 7. 7 Worst-Case Workshop Scenarios Identify, examine, and consider action about risks at a strategic level: External threats e.g. competition, loss of key staff, weather issues, terrorism Temporary issues e.g. loss of electricity, public transport, medical pandemic, IT or communication failure Market disruption e.g. lack of liquidity, changes in economy Consider scenarios as: 1. Consider relevance and potential impact 2. Determine necessary action 3. Periodically review Record outcome of workshops: Use workshops and a moderator

- 8. 8 ERM & Capital Adequacy Liquidity Risk Management 8

- 9. 9 ERM & Capital Adequacy Enterprise Stress Testing 9

- 10. 10 ERM & Capital Adequacy Risk Adjusted Performance Measurement 10

- 11. 11 ERM & Capital Adequacy Risk Materiality Assessment 11

- 12. 12 ERM & Capital Adequacy Capital Planning 12

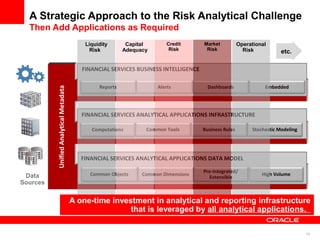

- 13. 13 A Strategic Approach to the Risk Analytical Challenge Begin with Firm Foundations v061510 A Financial Services data model, an ‘intelligent’ infrastructure, and a BI reporting layer used to drive all of our risk analytical solutions representing a one-time investment. 13

- 14. A Strategic Approach to the Risk Analytical Challenge Then Add Applications as Required UnifiedAnalyticalMetadata FINANCIAL SERVICES ANALYTICAL APPLICATIONS DATA MODEL FINANCIAL SERVICES ANALYTICAL APPLICATIONS INFRASTRUCTURE FINANCIAL SERVICES BUSINESS INTELLIGENCE Data Sources Reports Alerts Dashboards Embedded Computations Common Tools Business Rules Stochastic Modeling Common Objects Common Dimensions Pre-Integrated/ Extensible High Volume Liquidity Risk Capital Adequacy Credit Risk Market Risk 14 Operational Risk etc. A one-time investment in analytical and reporting infrastructure that is leveraged by all analytical applications.

- 15. 15 A “Joined Up” IT Strategy Potentially Allows: • Stress testing of key risks • Scenario analysis to see how ‘prepared’ the organisation is for the ‘unexpected’ event • Satisfy regulators with comprehensive risk assessments across the enterprise • Compliance risk is another type of operational risk • Internal Audit are partners with Compliance Managers with Operational Risk Managers to ensure compliance with internal standards and external regulations • Failure to comply with AML regulations adequately is a Compliance and Operational Risk • Fraud and cyber crime are both growing threats This “New Normal” requires a state of ‘Analytical Transformation’ This “New Normal” requires a state of ‘Analytical Transformation’

- 16. 16 What this means: • You don’t have to throw out your existing software • It does mean you need to think whether or not you really have a ‘joined-up’ IT strategy capable of delivering a ‘joined-up’ risk view Oracle Financial Services Analytical Applications Infrastructure and the necessary applications to fill the gaps Import Data Financial data warehouse

- 17. The following is intended to outline our general product direction. It is intended for information purposes only, and may not be incorporated into any contract. It is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, and timing of any features or functionality described for Oracle’s products remains at the sole discretion of Oracle.

Editor's Notes

- #6: Following the crisis of the past year, financial institutions find themselves under increasing scrutiny from regulators, shareholders and customers alike with regard to financial performance and stability. Compound this with stronger demands to manage enterprise risk. Liquidity management, capital adequacy and stress testing all figure prominently in the day to day management of the world’s financial institutions.

- #7: Using the Risk Category hierarchy, it is possible to define any type of risk in the Risk Library, and localize it for assessment in any business unit.

- #8: In addition to assessing risks individually by business unit, regulators expect businesses to look at risk at a higher level – on a scenario basis. How would the business cope with a flood, a pandemic of some kind, a transport strike, a terrorist attack, or market disruption through lack of available liquidity? Oracle Reveleus Operational Risk provides functionality where this type of risk can be recorded, and assessed, and action plans determined accordingly.

- #14: Oracle Team and Development Method Single Division Focused on Analytic Applications for Financial Services Significant New Investment in Development Resources Framework Based Approach to Development Common Objects Leveraged Across Solutions Allows greater speed to market E.g. Common retail pooling engine stratifies instrument groups for use in Basel II, ALM, FTP, Economic Capital E.g. Prepayment assumptions defined in single place and leveraged across the suite Business Logic Embedded in Rules Interface Users able to modify calculations to fit their business Oracle is using a framework-based approach to delivering these solutions. Common reusable objects are being leveraged across the solutions to deliver far more robust solutions to market with greater speed. For example, in forming the creation of retail pools, there is a common retail pooling engine that stratifies instrument groups for use in Basel II, ALM, FTP, and Economic Capital. Similarly, economic scenarios such as prepayment assumptions are defined in a single place and leveraged across the entire solution. An average daily balance used in a Basel II solution will be the same as what is used in a profitability calculation. Wherever possible, business logic is instantiated in a rules interface so that users may modify calculations to fit their businesses.

- #15: Oracle Team and Development Method Single Division Focused on Analytic Applications for Financial Services Significant New Investment in Development Resources Framework Based Approach to Development Common Objects Leveraged Across Solutions Allows greater speed to market E.g. Common retail pooling engine stratifies instrument groups for use in Basel II, ALM, FTP, Economic Capital E.g. Prepayment assumptions defined in single place and leveraged across the suite Business Logic Embedded in Rules Interface Users able to modify calculations to fit their business Oracle is using a framework-based approach to delivering these solutions. Common reusable objects are being leveraged across the solutions to deliver far more robust solutions to market with greater speed. For example, in forming the creation of retail pools, there is a common retail pooling engine that stratifies instrument groups for use in Basel II, ALM, FTP, and Economic Capital. Similarly, economic scenarios such as prepayment assumptions are defined in a single place and leveraged across the entire solution. An average daily balance used in a Basel II solution will be the same as what is used in a profitability calculation. Wherever possible, business logic is instantiated in a rules interface so that users may modify calculations to fit their businesses.