Magma Eng245 2017

- 1. Magma Arnaud Dusser Dan Slotcavage Renato MeloniJerónimo Emiliano García De Brahi Week 0: Our technology allows customers to switch glass between transparent and opaque states Week 10: We offer OEMs a luxury sunroof experience to differentiate their vehicles Total Interviews: 117 Market type: New Market

- 2. Formation of Magma Magma started with Dan’s PhD research in the McGehee Lab... … and formed around experts in each potential customer segment.

- 3. Team Members Jerónimo Emiliano García De Brahi Arnaud Dusser Dan Slotcavage Renato Meloni ● MSx, Master of Science in Management for Experienced Leaders ‘17 ● More than 15 years of experience related to the automotive industry (target market of this project) ● Automotive Expert ● MSx, Master of Science in Management for Experienced Leaders ‘17 ● Experience in funding and venture projects related to renewable energy ● MS in Sustainable Design and Construction (Civil Engineering) ● Experience in residential and commercial development/construction ● PhD in Materials Science and Engineering ● Technology Expert, based on his PhD research ● Team mentor ● Cofounder, CSO, Chief Strategist at LightSail Energy Danielle Fong

- 4. Our first MVP Transparent TransparentOpaque

- 6. Where is it currently being used? Jet Windows

- 7. Where is it currently being used? Mercedes Sunroofs

- 8. Where is it currently being used? Commercial Buildings

- 9. “As a startup, we needed to focus on one market. We chose construction. Rahul Bammi, CMO @ View. We realized that we couldn’t target every market

- 10. First, we got Out of the Building!

- 11. Hypothesis: Our product is for buildings. No More Blinds No More Glare Energy Savings Interviewed 42 building professionals/customers: Architects, Builders, Developers, Homeowners

- 12. Hypothesis: Our product is for buildings. No More Blinds No More Glare Energy Savings Interviewed 42 building professionals/customers: Architects, Builders, Developers, Homeowners

- 13. “ If money wasn’t an issue we would install dynamic glass in other projects, but right now it’s simply too expensive. Mike Messick, PM @ DPR Construction. Current products are too expensive

- 14. Lengthy building construction channels offer many opportunities to cut us out! Owner/ Real Estate Developer Engineering Architecture General Contractor Subcontractors Subcontractors Completed Commercial Building Glazier subcontractor IGU manufacturer Window ManufacturerMagma Magma Magma

- 15. Owner/ Real Estate Developer Engineering Architecture General Contractor Subcontractors Subcontractors Completed Commercial Building Glazier subcontractor IGU manufacturer Window ManufacturerMagma Magma Magma Two players to convince Lengthy building construction channels offer many opportunities to cut us out!

- 16. Owner/ Real Estate Developer Engineering Architecture General Contractor Subcontractors Subcontractors Completed Commercial Building Glazier subcontractor IGU manufacturer Window ManufacturerMagma Several actors require training to build/install the product properly Lengthy building construction channels offer many opportunities to cut us out!

- 17. Owner/ Real Estate Developer Engineering Architecture General Contractor Subcontractors Subcontractors Completed Commercial Building Glazier subcontractor IGU manufacturer Window ManufacturerMagma Magma Magma Premium product is easy to value engineer out at end of project 4 5 6 1 2 3 Lengthy building construction channels offer many opportunities to cut us out!

- 18. Owner/ Real Estate Developer Engineering Architecture General Contractor Subcontractors Subcontractors Completed Commercial Building Glazier subcontractor IGU manufacturer Window ManufacturerMagma Magma Magma Premium product is easy to value engineer out at end of project 4 5 6 1 2 3 Lengthy building construction channels offer many opportunities to cut us out!

- 19. We also looked at alternative, niche markets YACHTS JETS AR / VR RVs WEEK 2

- 20. Hypothesis: Our product is for luxury vehicles No More Shades Elegance Heat and Glare Control Interviewed 60 automotive experts/customers: OEMs, Tier-1/2 Suppliers, Dealers, Luxury car owners

- 21. Less fragmented market Strong value proposition Why the Automotive Industry? Access to knowledge and resources 1 BMW model = 1,470 individual homeowners

- 22. “ Glass is one of the materials where we would like to innovate but we don’t receive proposals from our suppliers. Carlos Paredes, Chief Purchasing Officer @ Magna Cosma. No clear leader in automotive glass tech

- 23. Key Stakeholders IP Fundraising (1st round) Prototyping Fundraising (2nd round) Facility OEM/Tier 1 Contracts Provisional Patent Lab-scale Prototype Company Creation Funding Prototype Optimization Testing material production OEMs VC (or traditional VC) Confirm OEMs interest Size Confirmation Build or Subcontract? Certification / Trials Commercial Negotiation Terms and Conditions SUPPLY University Grant Agencies / Government VC arm OEMs VC and Investors OEM Partners Tier 1 Partners Glass Producer Partners Material Suppliers $ $ $$ $$$ $$$ $$$ Lab Technical Expertise Funding Funding Chemists Lab / Equipment Materials Contacts Funding Manufacturing Capacity Engineers Manufacturing Capacity Engineers Legal Expertise Regulatory Approval Labor Regulatory Approval Labor Contacts Resources Activities Tasks Partners We found specific key players

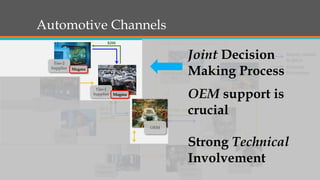

- 24. Automotive Channels Tier-2 Supplier Tier-2 Supplier Tier-1 Supplier Distributor & 3PL Dealer OEM R&D Service Supplier Customer Ind. After Market F & I Money related to glass Magma Magma Channel Economics Joint Decision Making Process OEM support is crucial Strong Technical Involvement

- 25. • OEMs • VC arms OEMs • Glass Producers • Tier 1 • Tier 2 • Research Labs • Luxury cars and new companies in the Market • Keep customers cool and comfortable • Block glare when sunny, allow light when desired • Cool: Almost no cars with similar feature • OEMs, specifically for luxury, need to differentiate • Become a Tier 2, partnering with OEM and Glass Producer The Automotive Approach

- 26. TAM, SAM and Year 7 Revenues # Cars manufactured in US/year: 12M cars % luxury + crossovers luxury vehicles: 20% BMW, GM (example assumed first adopters): 25% % of first adopters’ vehicles (BMW X5/6 series/Lincoln): 25% Smart glass/vehicle: 10 SqFt Revenue/sqft: $40 Year 7 revenue potential 12M * 20% * 25% * 25% * 10 SqFt * $40/SqFt = $60M 10 SqFt5 SqFt 5 SqFt 5 SqFt 5 SqFtTAM: $ 7,260 M SAM: $ 960 M Year 7 Revenue: $ 60 M

- 27. Final MVP 5x faster switching Neutral coloring 4x larger Original Final “Wow, that’s impressive” - Ben Cotton, Director of Sales at NSG Pilkington

- 28. Research and Development Pilot Certification and Scale Our path from prototyping to scaling and productionKEYMILESTONES

- 29. Research and Development Pilot Certification and Scale Financial / Operations TimelineKEYMILESTONES $350k 1ft x1ft. prototype

- 30. Research and Development Pilot Certification and Scale Financial / Operations TimelineKEYMILESTONES $500k Full 0.6m x 1m prototype

- 31. Research and Development Pilot Certification and Scale Financial / Operations TimelineKEYMILESTONES $3M Scale our production of prototypes and develop full pilot line

- 32. We may be a “shiny object” to glass companies Competitor Glass company involved in funding Amount/Date $65M Jan. 2017 $100M Jan. 2017 Acquired March 2012

- 33. What’s next? Building bigger prototype and patenting IP using Stanford resources Working on further interviews w/OEMs to make a decision about moving forward Moving on to work in the sustainable construction industry Moving on to work in the finance industry but will continue being involved with the company as an external advisor

- 34. Questions? Arnaud Dusser Dan Slotcavage Renato MeloniJerónimo Emiliano García De Brahi

- 35. Business Model Canvas • Automotive companies / parts suppliers (specifically we have connections with main automotive OEMs, General Motors Research and Aisin Technical Center) • Glass manufacturers Key Suppliers: • Glass manufacturers • Material suppliers • Deposition tool suppliers • Large-scale development of window production • File patents • Acquire funding for prototype • Develop manufacturing capability • Lab / manufacturing facilities • Process engineers • Corporate VCs (OEMs) • Manufacturing specialists • Less glare: Increased comfort for occupant of vehicle • Decreased solar heat gain and potential energy saving from decreased A/C • Removal of blinds and shades: less parts to produce a car and/or greater cleaning ease • Maintain expansive view • Act as supplier and provide product support • Word of mouth generation • Trade shows • Automotive OEMs and tier 1 and parts suppliers • Module sale to suppliers/tier 1 OEMs • Labor (assembly line workers, engineers, management) • Capex (pilot line equipment, full production line, space) • Materials (supplies for construction of window) • Smart glass (1 pane) sales to tier 1 OEM Week 9

- 36. Licensing vs. Selling Money Flow Magma Magma Licensing Selling

- 38. Week 8 Magma

- 39. Projected Revenue: Automotive # Cars manufactured in US/year: 12M cars % luxury + crossovers luxury vehicles: 20% BMW, GM (example assumed first adopters): 25% % of first adopters’ vehicles (BMW X5/6 series/Lincoln): 25% Glass/vehicle: 30 sqft Glass/vehicle that is smart: 30% Revenue/sqft: $40 Year 7 revenue potential 12M * 20% * 25% * 25% * 10 sqft * $40/sqft = $60M Luxury Source: IHS 10 sq ft5 sq ft 5 sq ft 5 sq ft 5 sq ft Crossover Midsize car Small car Pickup SUV Van Large car 11.1 11.6 12.0 12.3 12.1 12.1

- 40. Products / Services • Tunable transparency sunroofs • Controls for variable amounts of transmission (including automatic option) Pain relievers • Solar heating resolved • Customers don’t have to choose just one tint Gains Creators • Highly infrared reflective technology • Ability to go fully dark • Neutral coloring • Less parts needed to produce a car Value Proposition: Luxury Automotive Customer Segment: Automotive OEMs and part producers Pains • Sunroofs only exist in static tint • Heat through windows/sunroof can be uncomfortable • Light through windows/sunroof can be blinding (dangerous) • Have to sacrifice views for darkness • Removal of blinds and shades: less parts to produce a car or greater cleaning ease (But potentially removing good acoustics?) Gains • Passengers can choose desired opacity • View is preserved at all light intensities • More temperature comfort (avoid heating) • Aesthetic appeal • Differentiation Customer Jobs • Make automobiles sleek and sexy • Make passengers as comfortable as possible • Offer innovation in aesthetics and comfort Value Proposition Canvas Week 8

- 41. Get/Keep/Grow Diagram KEEP ExpansiontootherOEMs Competition betweenOEMs Awareness Interest Consideration/ Testing Purchase Viral Loop Trade shows Word of Mouth Business Relationships Product support (warranty, technical support) Tech improvement (switching time) Cost reduction (economies of scale) Usingproduct onmorecar models

- 42. • Automotive companies / parts suppliers (specifically we have connections with main automotive OEMs, General Motors Research and Aisin Technical Center) • Large residential / commercial construction developers (relationships with Irvine Company and Build SF) and architects Key Suppliers: • Glass manufacturers • Material suppliers • Deposition tool suppliers Week 1 • Understanding of specific customer demands for product • Large-scale development of window production • Lab / manufacturing facilities • Process engineers • Cheaper than existing electrochromics • Better and more Functional aesthetics: better transparency without blue hues • Significant energy savings (reflect infrared light, keeping spaces cooler) • Durability (technology is based in metal electrodeposition, and light won’t degrade the metals) Our customers expect us to act as a supplier • We create value for any window application. Automotive and aerospace manufacturers as well as residential and commercial construction all benefit from our technology. Traditional B2B interactions. We have already been approached by automotive suppliers • Materials costs (glass, ITO deposition, chemical salts) Development / construction of manufacturing line (including space for facility) • Process engineers • Technology licensing to automotive / aerospace manufacturers • Window sales to construction developers

- 43. • Automotive companies / parts suppliers (specifically we have connections with main automotive OEMs, General Motors Research and Aisin Technical Center) • Large residential / commercial construction developers (relationships with Irvine Company and Build SF) and architects • Aviation Companies • Niche consumers: Pilots, Motorcycle drivers, Bikers Key Suppliers: • Glass manufacturers • Material suppliers • Deposition tool suppliers Week 2 • Understanding of specific customer demands for product • Large-scale development of window production • Lab / manufacturing facilities • Process engineers • Cheaper than existing electrochromics • Better and more Functional aesthetics: better transparency without blue hues • Significant energy savings (reflect infrared light, keeping spaces cooler) • Durability (technology is based in metal electrodeposition, and light won’t degrade the metals) • Our customers expect us to act as a supplier • We create value for any window application. Automotive and aerospace manufacturers as well as residential and commercial construction all benefit from our technology. • Niche consumers: Pilots, Motorcycle drivers, Bikers • Traditional B2B interactions. • We have already been approached by automotive suppliers • Materials costs (glass, ITO deposition, chemical salts) Development / construction of manufacturing line (including space for facility) • Process engineers • Technology licensing to automotive / aerospace manufacturers • Window sales to construction developers • Sell lense and helmet to niche markets

- 44. Business Model Canvas • Automotive companies / parts suppliers (specifically we have connections with main automotive OEMs, General Motors Research and Aisin Technical Center) • Large residential / commercial construction developers (relationships with Irvine Company and Build SF) and architects • Aviation Companies • Niche consumers: Pilots, Motorcycle drivers, Bikers Key Suppliers: • Glass manufacturers • Material suppliers • Deposition tool suppliers • Understanding of specific customer demands for product • Large-scale development of window production • Lab / manufacturing facilities • Process engineers • Cheaper than existing electrochromics • Better and more Functional aesthetics: better transparency without blue hues • Significant energy savings (reflect infrared light, keeping spaces cooler) • Durability (technology is based in metal electrodeposition, and light won’t degrade the metals) • Our customers expect us to act as a supplier • We create value for any window application. Automotive and aerospace manufacturers as well as residential and commercial construction all benefit from our technology. • Niche consumers: Pilots, Motorcycle drivers, Bikers • Traditional B2B interactions. • We have already been approached by automotive suppliers • Materials costs (glass, ITO deposition, chemical salts) Development / construction of manufacturing line (including space for facility) • Process engineers • Technology licensing to automotive / aerospace manufacturers • Window sales to construction developers • Sell lenses and helmet to niche markets Week 3

- 45. Business Model Canvas • Automotive companies / parts suppliers (specifically we have connections with main automotive OEMs, General Motors Research and Aisin Technical Center) • Large residential / commercial construction developers (relationships with Irvine Company and Build SF) and architects • Aviation Companies • Niche consumers: Pilots, Motorcycle drivers, Bikers Key Suppliers: • Glass manufacturers • Material suppliers • Deposition tool suppliers • Understanding of specific customer demands for product • Large-scale development of window production • Lab / manufacturing facilities • Process engineers • Less glare: Increased comfort for occupant of building or vehicle • Removal of direct sunlight allows for an increase of floor space usage • Decreased solar heat gain and potential energy saving from decreased A/C • Removal of blinds and shades: less parts to produce a car and/or greater cleaning ease • Maintain expensive view • Our customers expect us to act as a supplier • Act as supplier and provide product support • Commercial real estate buyers (developers//clients) • Automotive OEMs and tier 1 and parts suppliers • Niche consumers: Pilots, Motorcycle drivers, Cyclists, RVs and Yachts • Traditional B2B interactions. • We have already been approached by automotive suppliers • Module sale to suppliers/tier 1 OEMs • Sales to commercial developers • Materials costs (glass, ITO deposition, chemical salts) Development / construction of manufacturing line (including space for facility) • Process engineers • Technology licensing to automotive / aerospace manufacturers • Sunroof sales to automotive manufacturers (tier 1, OEMs) • Window sales to construction developers • Sell lenses and helmet to niche markets Week 4

- 46. Business Model Canvas • Automotive companies / parts suppliers (specifically we have connections with main automotive OEMs, General Motors Research and Aisin Technical Center) • Large residential / commercial construction developers (relationships with Irvine Company and Build SF) and architects • Aviation Companies • Niche consumers: Pilots, Motorcycle drivers, Bikers, RV or Yacht owners Key Suppliers: • Glass manufacturers • Material suppliers • Deposition tool suppliers • Understanding of specific customer demands for product • Large-scale development of window production • Lab / manufacturing facilities • Process engineers • Less glare: Increased comfort for occupant of building or vehicle • Removal of direct sunlight allows for an increase of floor space usage • Decreased solar heat gain and potential energy saving from decreased A/C • Removal of blinds and shades: less parts to produce a car and/or greater cleaning ease • Maintain expansive view • Act as supplier and provide product support • Word of mouth generation • Trade shows • Commercial real estate buyers (developers//clients) • Automotive OEMs and tier 1 and parts suppliers • Niche consumers: Motorcycle drivers, RV and Yachts (as starting point) • Module sale to suppliers/tier 1 OEMs • Sales to commercial developers • Materials costs (glass, ITO deposition, chemical salts) Development / construction of manufacturing line (including space for facility) • Process engineers • Sunroof sales to automotive manufacturers (tier 1, OEMs) • Window sales to construction developers Week 5

- 47. Business Model Canvas • Automotive companies / parts suppliers (specifically we have connections with main automotive OEMs, General Motors Research and Aisin Technical Center) • RV or Yacht owners Key Suppliers: • Glass manufacturers • Material suppliers • Deposition tool suppliers • Understanding of specific customer demands for product • Large-scale development of window production • Lab / manufacturing facilities • Process engineers • Less glare: Increased comfort for occupant of vehicle • Decreased solar heat gain and potential energy saving from decreased A/C • Removal of blinds and shades: less parts to produce a car and/or greater cleaning ease • Maintain expansive view • Act as supplier and provide product support • Word of mouth generation • Trade shows • Automotive OEMs and tier 1 and parts suppliers • Niche consumers: Motorcycle drivers, RV and Yachts (as starting point) • Module sale to suppliers/tier 1 OEMs • Materials costs (glass, ITO deposition, chemical salts) Development / construction of manufacturing line (including space for facility) • Process engineers • Sunroof sales to automotive manufacturers (tier 1, OEMs) Week 6

- 48. Business Model Canvas • Automotive companies / parts suppliers (specifically we have connections with main automotive OEMs, General Motors Research and Aisin Technical Center) • RV or Yacht owners Key Suppliers: • Glass manufacturers • Material suppliers • Deposition tool suppliers • Understanding of specific customer demands for product • Large-scale development of window production • File patents • Acquire funding for prototype • Develop manufacturing capability • Lab / manufacturing facilities • Process engineers • Corporate VCs (OEMs) • Manufacturing specialists • Less glare: Increased comfort for occupant of vehicle • Decreased solar heat gain and potential energy saving from decreased A/C • Removal of blinds and shades: less parts to produce a car and/or greater cleaning ease • Maintain expansive view • Act as supplier and provide product support • Word of mouth generation • Trade shows • Automotive OEMs and tier 1 and parts suppliers • Niche consumers: Motorcycle drivers, RV and Yachts (as starting point) • Module sale to suppliers/tier 1 OEMs • Process engineers • Materials costs (glass, ITO deposition, chemical salts) • Development / construction of manufacturing line (including space for facility) • Sunroof sales to automotive manufacturers (tier 1, OEMs) Week 7

- 49. Business Model Canvas • Automotive companies / parts suppliers (specifically we have connections with main automotive OEMs, General Motors Research and Aisin Technical Center) • Glass manufacturers • RV or Yacht owners Key Suppliers: • Glass manufacturers • Material suppliers • Deposition tool suppliers • Large-scale development of window production • File patents • Acquire funding for prototype • Develop manufacturing capability • Lab / manufacturing facilities • Process engineers • Corporate VCs (OEMs) • Manufacturing specialists • Less glare: Increased comfort for occupant of vehicle • Decreased solar heat gain and potential energy saving from decreased A/C • Removal of blinds and shades: less parts to produce a car and/or greater cleaning ease • Maintain expansive view • Act as supplier and provide product support • Word of mouth generation • Trade shows • Automotive OEMs and tier 1 and parts suppliers • Niche consumers: Motorcycle drivers, RV and Yachts (as starting point) • Module sale to suppliers/tier 1 OEMs • Labor (assembly line workers, engineers, management) • Capex (pilot line equipment, full production line, space) • Materials (supplies for construction of window) • Sunroof sales to automotive manufacturers (tier 1, OEMs) • Smart glass (1 pane) sales to tier 1 OEM Week 8

- 50. Customer Interviews ● Construction - Customers: 13 Contractors, 1 Architect/Builder ● Building: 2 Architects ● Construction - Customers: 3 Architects,1 Real Estate Developer, 1 Architect/GC, 2 General Contractors 2 Architect/Builder, 1 Architect/Owner, 1 Residential Architect, ● 1 Recent Home Builder, 1 Hotel Designer,,1 Home- Owner, ● Construction - Competitors: 3 Competitors ● Construction - Competitors: 2 Glass fabricators ● Construction - Competitors: 1 Marketing VP of main competitor ● Construction - Competitors: 1 Dynamic film fabricator ● Construction - Customers: 1 Building Expert, ● Construction - Customers:1 Building Expert ● 1 Window Expert, ● Construction - Customers: 2 Partners, 1 Building Automator ● Aviation: 1 Recreational Pilot/Aerospace engineer ● Aviation: 1 Military Pilot, 1 Commercial Pilot ● Aviation: 5 Flight Attendants ● Aerospace: 1 Spaceship Engineer ● AR/VR: 2 Customer ● Yachts: 1 Avid Sailor ● Boat owners: 3 Sailors ● Automotive - Customers: 2 Purchasers, ● Automotive - Customers: 1 Automotive fabricator ● 1 OEM, ● 7 Automotive engineers, 2 Executives ● 2 Engineers, 1 Executive, ● Automotive - OEM: 3 ● 3 OEMs ● Automotive - Customers: 2 Automotive Suppliers, ● 2 Automotive Suppliers, ● Automotive - Tier-1: 2 ● Automotive - Customers: / 1 Automotive Supplier ● Supplier: 1 Glass supplier ● Competitors: 1 Co-founder ● Automotive - Customers: 3 Sales Representatives, 1 Dealer ● Automotive - Customers: 1 Sales Representatives, ● Automotive - Customers: 3 Luxury car owners ● Car owners: 2 Luxury car owners ● 1 Automotive customer, 1 motorcycle driver ● Experts: 1 Licensing Lawyer, 1 Green tech VC ● Expert: 1 Automotive Research Institute ● 1 SBIR grant recipient ● Experts: 1 Clean-tech VC ● 1 R&D ● Potential Partners: 1 Transparent Solar Cell Startup ● Construction: 42 ○ Architects/Builders: 27 (Contractors, Developers, Residential/Commercial Architects) ○ Competitors: 6 ○ End Customers: 3 (Homeowners) ○ Partners: 3 (Building automator, fabricators) ○ Experts: 3 (Energy Efficiency, Windows) ● Automotive: 60 ○ OEMs: 23 (Executives, Engineers, fabricators) ○ Suppliers: 11 (Glass, Tier-1) ○ End customers: 7 (Luxury car owners) ○ Experts: 7 (Licensing, Green Tech, R&D) ○ Dealers: 8 ○ Competitors: 2 ○ Partners: 2 ● Niche Markets: 15 ○ Aviation: 9 (Flight Attendants, Engineers, Pilots) ○ Yachts: 4 (boat owners) ○ AR/VR: 2 (End customers)