Opening Electricity Industry to Investors: an academic perspective

- 1. Medelec – Eurelectric Brussels - 6 May 2015 Opening Electricity Industry to Investors: an academic perspective Jean-Michel Glachant Loyola de Palacio Prof. & Director Florence School of Regulation European University Institute (Florence) Robert Schuman Centre for Advanced Studies Florence School of Regulation & Loyola de Palacio Chair

- 2. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies EU power market opening along 10 years of Barroso‘s Commissions 2 Day-ahead market Intraday markets Balancing market Reserves/ ancillary services markets Explicit auctions for transmission capacity Implicit auctions Market coupling Market splitting Capacity markets Bilateral / OTC Long term contracts Flexibility market Baseload product Peak load product Congestion management

- 3. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies I will simplify around 4 blocks only … 3 Entry in generation Access to 1 MW consumers NO Entry in generation Entry in generation NO Access to grid NO Access to consumers Entry in generation only IF 2- Monopoly + LT fran. IPPs Access to grid NO Access to consumers 1- Monopoly Access to grid 3- Single Buyer + Wh. Market 4- Wh. Market + Eligible xMW NO Access to grid Long Term contract with monopoly

- 4. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Model 1 (-) Monopoly Model 2 (+) Franchised IPPs Model 3 (++) Single Buyer + Wholesale Competition Model 4 (+++) Wholesale Comp. + Eligible Consumers + Retail S.B. Power sector can become more like an open commodity industry But: • More complexity, regulation, IT infrastructure, etc • AND More structural changes needed Let’s simplify it a bit: 4 basic models of opening 4

- 5. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Introduction “Opening power industry to investors : 4 basic industry models with or without market” 1.(Model 1) No opening 2.(Model 2) Opening to “franchised” generation 3. (Model 3) Opening to generation competition 4. (Model 4) Opening to eligible (xMW)consumers

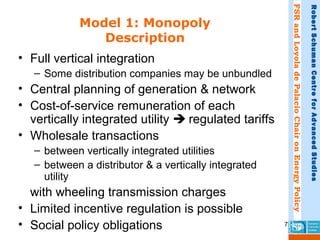

- 7. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 7 Model 1: Monopoly Description • Full vertical integration – Some distribution companies may be unbundled • Central planning of generation & network • Cost-of-service remuneration of each vertically integrated utility regulated tariffs • Wholesale transactions – between vertically integrated utilities – between a distributor & a vertically integrated utility with wheeling transmission charges • Limited incentive regulation is possible • Social policy obligations

- 8. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 8 Model 1: Monopoly Comments • Most risks are passed to consumers – mistakes in investment unit size &location, demand forecast, techno. obsolescence, etc. • Abuse of social policy obligations (utility as tax collector) – indigenous fuels, fuel diversity, nuclear moratoria, electricity discounts, local taxes, etc. • Abuse of “Utility-sweeping”, regulatory lag & “lack of funds” – No adequate tariffs & rate of return to utility> Underinvestment & excessive operational costs • Pressure from cheaper potential new entrants

- 9. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Introduction “Opening power industry to investors : 4 basic industry models with or without market” 1.(Model 1) No opening 2.(Model 2) Opening to “franchised” generation 3. (Model 3) Opening to generation competition 4. (Model 4) Opening to eligible (xMW)consumers

- 10. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 10 Model (2) Monopoly + “Franchised” Ipps Generation Transmission Distribution/ Retail Consumers IPP IPP IPP IPP

- 11. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 11 Model 2: Franchised IPPs • IPPs compete to get the “monopoly power” at generation stage • “LT contracts” give them Franchise: “quasi vertical integration” • Central planning of generation & network is kept by incumbent monopoly. Bad planning & bad contracting are major risks • Limited Reform because wholesale transactions implemented by incumbent integrated Monopoly (but Chinese trick: price guaranteed; not volume dispatched) • Costs of competitive bidding of IPP Franchise regulated tariffs (risks passed to consumers as in Monopoly model) • Some incentive regulation is possible (performance based contract & profit sharing; etc. )

- 12. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Introduction “Opening power industry to investors : 4 basic industry models with or without market” 1.(Model 1) No opening 2.(Model 2) Opening to “franchised” generation 3. (Model 3) Opening to generation competition 4. (Model 4) Opening to eligible (xMW)consumers

- 13. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 13 (Model (3) From <Monopoly + IPPs> to <Single Buyer + Wholesale Market > IPP Single Buyer Distribution/ Retailer Consumer IPP Divest. Distribution/ Retailer Consumer IPP Single Buyer Distribution/ Retailer Consumer IPP Distribution/ Retailer Consumer Own generation

- 14. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 14 Model 3: Single Buyer Description (1) • Less vertical integration than model 1 & 2 • Independent Power Producers (IPPs) compete to sell to the single buyer a/ Ex Ante competition (e.g. bids) in construction, operation & negotiation of contracts (PPAs) with the single buyer b/ Ex Ante & Ex Post competition: Single Buyer buy Wholesale Market with no LT contract with IPPs • Is Single Buyer responsible for generation adequacy? LT contracts? Capacity Options? • Some economic incentives with LT contracts –“availability” payments; indexation of variable costs

- 15. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 15 Model 3: Single Buyer Description (2) • Cost-of-service, PPA contracts & social policy obligations regulated tariff • Access to consumers: as in model 1. IPPs do not have retail access • Single Buyer (via consumers’ tariffs) can take the generators’ risk in LT contracts • Independence of the Single Buyer becomes a critical issue (Merit Order & economic dispatch of IPPs) • The transmission grid becomes key implementation

- 16. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 16 Model 3: Single Buyer Description (3) • Various degrees of competition on the generation side, while the purchasing agency can keep centralized strategic control (capacity adequacy & technology mix; merit order) • But if Single Buyer controls it keeps typical drawbacks of centralized planning • Risk of IPPs being made LT contracts is passed to consumers lower capital costs & easier to raise capital • If LT contracts used it requires effective control of contracting & implementation is needed (corruption likely)

- 17. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Introduction “Opening power industry to investors : 4 basic industry models with or without market” 1.(Model 1) No opening 2.(Model 2) Opening to “franchised” generation 3. (Model 3) Opening to generation competition 4. (Model 4) Opening to eligible (xMW)consumers

- 18. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 18 (Model 4) Wholesale Market +eligible consumers Generator Power Exchange Supplier Eligible consumer Generator Generator Distributor/ Retailer Captive consumer Supplier Distributor/ Retailer Eligible consumer Captive consumer Wholesale market Retail market

- 19. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 19 Model 4: Wholesale competition Description (1) • Free transactions between distributors & generators, thus sharing risks • Distributors (now multiple purchasing agencies) maintain a monopoly over final consumers regulated tariffs • Social policy obligations must be charged via regulated tariffs • No central planning of generation, free entry • Generation stranded costs & benefits appear

- 20. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 20 Model 4: Wholesale competition Description (2) • Trading arrangements – open access & ancillary services system operator – organized markets (spot, derivatives) market operator (not a single buyer, but an auctioneer) – bilateral wholesale contracts – IPPs may choose between contracts & the spot market – regulated network access charges

- 21. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 21 Model 4: Wholesale competition Comments • IPPs may / may not be vertically integrated with distributors (risk of self dealing) • Issues of market power are now relevant • Long term guarantee of supply is in principle left to the market: will it work? • Strong incentive to efficiency in generation • Any pressure from consumers to arrive at retail competition : depends level regulated tariffs

- 22. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Conclusion “Opening power industry to investors : 4 basic industry models with or without market” 1. Choice of model depends appetite of public authorities for power reforms & expectations from Power Opening (Capital flow? Technology renewal? Efficient management? Stop energy subsidy? etc.) 2. Opening to “franchised” generation (Monopoly + Franchised IPPs) needs limited reforms BUT all risks (volumes, technical options & contract formulas) for consumers (except if Gov. breaches contract…) 3. Opening to generation competition (Single Buyer + Wholesale Market) more reform needed & investment risks transferred to generators. BUT to get capacity adequacy? Capacity incentives or not? 4. Opening to eligible (xMW)consumers (Wholesale Market + eligible Wh. Consumers + single buyer retail) much more reform needed & risks are transferred both to generators & eligible consumers while retail can stay “Single Buyer ”with some “capacity incentives”?

- 23. Florence School offers you World First Online Course “Power Regulation” •Course directed by Ignacio Pérez-Arriaga (from his own course @MIT) •20 weeks of flexible online training •Exclusive access to Pérez-Arriaga’s textbook Regulation of Power Sector •Direct interaction with a Faculty of leading experts •A Certificate of attendance (by FSR & by Comillas University) •Support from the whole FSR Online Community First edition oversubscribed (200 registered + 40 waiting list) Next term starts November 2015 http://florenceonlineschool.eui.eu/

- 24. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies 24 Thank you for your attention Email contact: jean-michel.glachant@eui.eu Follow me on Twitter / already 7 575 tweets: @JMGlachant Read the Academic Journal I am chief-editor of: EEEP “Economics of Energy & Environmental Policy” My web site: http://www.florence-school.eu

- 25. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Annexes 5.(Annexe 1) In-depth Wholesale Market opening: a sequence of markets 6.(Annexe 2) From national market to international markets

- 26. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies (Models 3 & 4) Electricity characteristics influencing trade Non-storable “Immaterial” Energy 1° Traded before delivery = trade price insurance (= financial transaction) 2° No “storable effect” on prices (as for gas) (“spread” Summer / Winter) 3° Production and consumption in real time 4° “Zero” tolerance of imbalances P-C + sensitivity to “network” constraints (congestion) 5° Collective equilibrium Total Prod= Total Cons over one control area (zone under the control of a “TSO”)

- 27. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Electricity vs. Air Transport 1° No plane can take off or land if it is not completely full (of passengers) 2° To go from A to B, all planes should have to divide themselves to pass through AB but also through AC-CB. 3° If a plane breaks over a flight, all the other planes should have to take instantaneously all its passengers (following 1°) or… all the other planes break suddenly. (Models 3&4) Electricity characteristics influencing trade (cont.)

- 28. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies (Model 3&4) Wholesale market proxies Electricity and the sequence of markets 1° Electricity good = “system” good = Energy + Transmission (congestion) + Capacity (reserves) 2° Sequence of (at least) four markets = Day-ahead Energy Market (D-1) + Transmission Market (or congestion pricing) + (short-term and long-term) capacity/reserves markets + Combination of 3 in real time Balancing 3° = All electricity market design is ‘’complex’’

- 29. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies (Models 3&4) Wholesale market architecture • Electricity = Energy (Day-ahead and intraday) + Congestion pricing + Reserves (and Generation Capacity mechanisms) + Real Time Balancing Intraday markets Balancing Market Congestion pricing Day-ahead market TimeDelivery Generation capacity mechanisms

- 30. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies (Model 3&4) Day-ahead market design • Options : – Centralization (organized: Pool & PX) vs. Decentralization (bilateral/OTC) • Differences : – Available Information – Liquidity – Speed for finding a market equilibrium – Flexibility of decision and actions

- 31. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Commercial (or “Financial”) Relationships in Liberalised Electricity Markets Generator 3Generator 2Generator 1 Supplier 1 Trader 2 Wholesaler 3 PX TSO Final Consumer 1 Final Consumer 2 Final Consumer 4 Final Consumer 3 Final Consumer 5 PX Sales PX Purchases Bilateral Contracts Supply Contracts

- 32. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Bilateral Over-the-Counter (OTC) vs. Power Exchange Trading Properties Trading Method Over-the-Counter Power Exchange Anonymity of Trading No Yes Counterparty Bilateral Central Counterparty Counterparty Risk Yes, unless Cleared No Trading Method Continuous Trading Typically Central Auction

- 33. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies • Bilateral contracts may be: • Customised • Respond to the requirements of the counterparties • Reduce basis risk … • But requirements of the counterparties may not always be compatible • Standardised • Standard features and clauses • Easier to negotiate • Easier to trade in a secondary market • Brokers may facilitate the conclusion of bilateral contracts by matching counterparties with compatible requirements Bilateral trading

- 34. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies • Efficient, merit-order dispatch according to offers submitted to the PX. • Separation between generation and supply, the two potentially-competitive activities in the electricity sector, which, in many countries, are still characterised by (vertically-integrated) dominant players. • Greater transparency in price setting. Prices reflect market conditions and thus vary hour by hour. PX prices are published daily and provide a reliable reference. Power Exchange - System Level Benefits

- 35. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies • Easier entry into the market by new players. Non-discriminatory access to wholesale power. New entrants in the generation business may sell power at fair prices. New entrants in the supply business may buy wholesale power at fair prices. • Increased security of supply (IF… & only if!) Promotion of generation capacity availability and load management at peak times. – More accurate price signals on the relationship between demand and supply. PX- System Level Benefits Ct

- 36. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies • Market-place where electricity is available at market prices • Greater flexibility in generation and consumption strategies (revision of scheduled generation or consumption close to real time) • Guaranteed payment of electricity through a central counterparty and guarantee requirements PX- Participants Level Benefits

- 37. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies • Trading results in long/short positions *Long positions assign the right/obligation to withdraw power from the grid *Short positions assign the right/obligation to inject power into the grid *Long and short position resulting from trading should be balanced (injections = withdrawals) in each delivery period Trading of promises and commodity delivery (1)

- 38. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies • “Gate Closure” is the deadline for trading electricity to be delivered in a specified period • Gate Closure could be from one or more days to one hour or less before delivery time • By Gate Closure, balanced (injections and withdrawal) positions are declared (possibly through balance responsible agents) to the relevant TSO (scheduling). (The PX may itself be a balance responsible agent) Trading and commodity delivery (2)

- 39. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies • At Gate Closure the TSO takes over the management of electricity flows over the network • Deviations of actual injections/withdrawals from positions attract imbalance changes and are settled with the TSO (balancing charges) Trading and commodity delivery (3)

- 40. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Balancing & Settlement Agreements Physical (or “Technical” or “Electrical”) Relationships in Liberalised Electricity Markets Generator 3Generator 2Generator 1 Supplier 1 Trader 2 Wholesaler 3 PX TSO Final Consumer 1 Final Consumer 2 Final Consumer 4 Final Consumer 3 Final Consumer 5 Connection, Use-of-System and Balancing & Settlement Agreements Connection and Use-of-System Agreements

- 41. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies (5) Design of Balancing -Real Time- • Options : – Balancing Market vs. Mechanism – Single vs dual imbalance prices (penalties) • Issues : – System security vs. market efficiency – Centralized vs. Decentralized balancing – Market Power – Reflectiveness & Cost allocation problem – Impact of distorsions (Incumbent vs. New entrants)

- 42. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies (5) – Design of transmission markets (or congestion pricing) • Design of internalisation of “network” externalities = energy market + economic model of network constraints • Economic models of network in energy markets – Zonal model (EU: Nord Pool) – Nodal model (USA: PJM) • «Optimal» economic model of the network ? – Zonal for “zonable” networks – Nodal for “non-zonable” networks • Market vs. Control by TSO • Zonal for “non-zonable” networks • Trade-off between energy market functioning (liquidity) vs. ‘Gaming’ & inefficiencies • Putting incentives on the TSO for optimal control (e.g. UK)

- 43. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies RealNetworkNetworkeconomicmodel NetworkPhysical functioning Market Design Internalisation of all networkeffects ((nodalnodal)) Internalisation of more important network effets (zonal(zonal)) market does not internalise network Design of internalisation of network in energy markets: several proxies Networkmanagem Marketsolution

- 44. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Internalisation of network constraints by the energy market : when? • Uncertainties in the measure of network effects – E.g. : Maximal transmission capacity between two zones depends on … actual network flows • Internalisation of the network before real time without re-internalization in real time – Maximal capacity in real-time becomes the minimal capacity defined « ex ante » – The market adds new constraints and does not maximize the potential benefits from trade

- 45. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies (5) RESERVES a/ Short-term Reserves’ markets • Why? – Short-term reserves are “available capacity” then “public goods” (they cannot be provided selectively to individual grid users) – They are provided trough TSOs’ procurement rules • Resources for the provision of reserves can be: – Supplied by grid users according to license conditions (e.g. Primary reserve: instantaneously) – Procured by the TSO through long-term contracts (e.g. Secondary reserve: each 5 to 15 minutes) – Procured by the TSO through dedicated markets (e.g. Tertiary reserve: 15 minutes to half-daily schedule)

- 46. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies (5) b/ Long term Generation capacity mechanisms • Why? From short term to long term capacity offer – Right level of generation capacity? Through markets? Investing in base to peak units? – Missing money • Price cap • Risk • Market power • Options of capacity procurement design – Capacity payments – Capacity markets – Etc.

- 47. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Annexes 5.(Annexe 1) In-depth Wholesale Market opening: a sequence of markets 6.(Annexe 2) From national market to international markets

- 48. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies (6) From National to Regional markets • Historically, grids have been developed mainly to serve national markets • ... At a time when national markets were typically served by vertically-integrated monopolists • ... Which had little incentive to integrate neighbouring markets, except for security and stability purposes • Therefore, regional market integration requires: • Harmonisation of rules • Expansion of cross-border capacity • Efficient management of existing capacity

- 49. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Cross-border Congestion Management (1) • Congestion occurs when the available transmission capacity is not sufficient to satisfy the demand for transmission services (e.g., from commercial transactions) • Therefore, congestion depends: • on the demand for transmission services • on the available transmission capacity

- 50. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies • Liberalization has increased and made more explicit the demand for transmission services • Congestion may occur: • within a control area • between control areas (cross-border) • For ex. First EC rules (e.g. Regulation n. 1228/2003) only apply to cross-border congestion Cross-border Congestion Management (2)

- 51. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Approaches to congestion management Basic approaches: • Ex-post market adjustment to congestion • Redispatching • Counter-trading • Ex-ante congestion management • Explicit allocation of (physical) transmission capacity rights (PTRs) • Implicit allocation of transmission rights (based on energy positions): • Implicit Auction • Market Splitting • Market Coupling (market splitting among several PXs instead of single PX)

- 52. FSRandLoyoladePalacioChaironEnergyPolicy RobertSchumanCentreforAdvancedStudies Congestion Management in Europe • Market splitting was dominant in: • NordPool: between national control areas and between Norwegian zones • Italy GME: between different geographical areas (for generators only) • In other EU markets, congestion within a control area was managed through redispatching • Flow-based Market Coupling has been proposed by ETSO – Europex to solve cross-border congestion & became EU Target Model

- 53. Thank you for your attention to Annexes !