multiple projects and constraints

- 1. Multiple Projects and Constraints 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 1

- 2. Multiple projects and constraints • In isolation, Investment projects can be evaluated on any of discounted cash flow method (NPV, IRR, B/C ratio etc.) for correct decision making. • In existing organization capital investment decisions can’t be taken in isolation due to lack of capital rationing and project independence • Without considering the constraints, the rational criterion of project evaluation (NPV, IRR, etc) may lead to wrong decisions 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 2

- 3. Constraints: Project dependence Project A and B are financially independent if acceptance or rejection of one does not affect the cash flow of other or does not affect acceptance or rejection of other. (Ex. Investment in boiler and investment in computer network are independent) Mutually exclusive projects: (Alternative projects) . Acceptance of one project automatically precludes the other mutually exclusive projects. Negatively dependent projects : Projects though not mutually exclusive but negatively influence each others cash flows (Ex. Building a bridge and buying commercial ferry) Positively dependent projects: (Complementary projects) undertaking of a project positively affects cash flows of other. ▪ symmetric complementary: positive effect in both direction only (taking A or B benefits other) ▪ asymmetric complementary: positive effect in one direction only (taking A benefits B but taking B does not benefit A) 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 3

- 4. Constraints: Capital Rationing • Capital rationing exists when capital available is inadequate to undertake all projects which are otherwise acceptable. • Capital rationing may arise because of internal limitation or external constraints. • Internal capital rationing is caused by management decision to set a limit on capital expenditure outlays. • External capital rationing arise out of firm’s inability to raise sufficient fund at a given cost of capital. • Implication of cost of capital curve is that some projects which might have been acceptable if cost of capital being constant , have to be abandoned or postponed 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 4 Quantum of fund raised Costofcapital

- 5. Constraints: Project Indivisibility: A Capital project has to be accepted in Toto i.e. it can not be accepted partially Ex. Three indivisible projects A, B and C require investment of Rs 5 crore, 4 crore and 3 crore. NPV of the projects are 2 crore, 1.5 crore and 1 crore respectively. On the basis of NPV Project A is superior. But acceptance of A with NPV of 2 crore makes sure rejection of B and C due to capital rationing, which together provides NPV of 2.5 crore. Thus comparison of projects under constraints is required to make a suitable financial decision 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 5

- 6. Comparing projects under constraint: Method of ranking Approaches of comparing projects under constraints ▪ Method of ranking ▪ Method of mathematical Programming Method of ranking consists of two steps o Rank all project under descending order on the basis of financial criterion ( NPV, etc.) o Accept project in same order till the capital is exhausted Method of ranking is impaired with two problems • Conflict in ranking as per discounted cash flow criteria • Project indivisibility 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 6

- 7. Comparing projects under constraint: Method of ranking Project Investment (Rs) Expected Annual Cash flow (Rs) Project Life (years) NPV @12 % Ranking on basis of NPV IRR (%) Ranking on basis of IRR B/C ratio Ranking on basis of B/C ratio A 10000 4000 12 14776 4 39 1 2.48 1 B 25000 10000 4 5370 5 22 4 1.21 5 C 30000 6000 20 14814 3 19 5 1.49 4 D 38000 12000 16 45688 1 30 3 2.20 2 E 35000 12000 9 28936 2 31 2 1.83 3 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 7

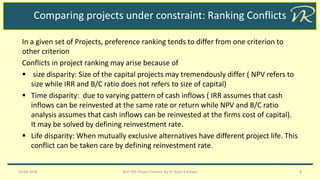

- 8. Comparing projects under constraint: Ranking Conflicts In a given set of Projects, preference ranking tends to differ from one criterion to other criterion Conflicts in project ranking may arise because of ▪ size disparity: Size of the capital projects may tremendously differ ( NPV refers to size while IRR and B/C ratio does not refers to size of capital) ▪ Time disparity: due to varying pattern of cash inflows ( IRR assumes that cash inflows can be reinvested at the same rate or return while NPV and B/C ratio analysis assumes that cash inflows can be reinvested at the firms cost of capital). It may be solved by defining reinvestment rate. ▪ Life disparity: When mutually exclusive alternatives have different project life. This conflict can be taken care by defining reinvestment rate. 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 8

- 9. Comparing projects under constraint: Project Indivisibility Project indivisibility may pose a problem in project ranking method. The problem may be resolved by Feasible combination approach • Defined all possible combinations considering the constraints • Choose the feasible combination which has large NPV 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 9

- 10. Comparing projects under constraint: Mathematical programming approach Feasible combination approach tends to be cumbersome if number of projects increases. The solution lies in mathematical programming model. This approach helps in determining optimum solution ( most desirable combination of projects) A mathematical model is formulated in form of • Objective function • Constraint equation Type of mathematical programming models • Linear Programming model • Integer Programming model • Goal Programming Model 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 10

- 11. Thank You 19-04-2018 BCH 505 Project Finance by Dr Naim R Kidwai 11 Contact Email: naimkidwai@gmail.com https://nrkidwai.wordpress.com/