Petx I-Corps@NIH 121014

- 1. Team 17 PET/X Improving outcomes, reducing costs Initial idea: Help oncologists pick better personalized therapies for breast-cancer patients $10B TAM $1.2B SAM $600M Target Pa:ent B Tx Failed ✗ Pa:ent A ✓ Tx Worked Before 1 dose Tx AAer Total interviews: 106

- 2. Larry MacDonald Co-‐Founder (IE) Background: Biomedical Physics Paul Kinahan Co-‐Founder (CL) Background: Engineering Physics Team 17 William Hunter Principal Inves:gator (PI) Background: Nuclear & Semiconductor Physics PET/X Improving outcomes, reducing costs

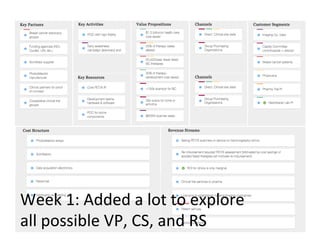

- 3. Week 1: Added a lot to explore all possible VP, CS, and RS

- 4. A"er Week 1: Posi.ve indica.ons for key VP Hypothesis Experiment Results New technology requires trial Asked developers of previous data (mul:ple) projects A magic image can change an industry more quickly (but opposing views on this) Results from current clinical PET/CT scanners provide low-‐ fidelity MVP data Asked medical imaging clinical experts Affirmed Insurance companies have small research programs Asked ques:on to a healthcare economist Some insurance companies have huge research programs/budgets No role for PET/X in diagnosis Asked mul:ple clinicians Strong support for use in diagnosis (opposing views) 90% of new BC pa:ents are candidates Asked medical imaging clinical experts only 35% for sure, could go up to 75% Payers and providers are separate customers Serendipitous ques:on to a healthcare economist Combined payer/providers would be good first adopters No reimbursement limit (on numbers of scans) Asked na:onal medical imaging clinical experts Affirmed

- 5. Week 4: Start to rule out CS, VP based on interviews

- 6. W

- 7. eek 4 (VPCS): Thinning

- 9. ! #

- 10. # $%

- 11. ' ( (! (

- 12. )!' ' *+ !! ,

- 13. , !- ,) . /,) 0 (,( '1 ' 2 Reimbursment Decision Maker Coopera:ve trial PI

- 14. Aer Week 4: Differen.ated Customer segments Hypothesis Experiment (n) Results Fixed materials price :ers ; materials subject to tariffs Interview materials vendor (2) Found vendor with lower and (claimed) controlled price Billing: Reimbursement is feasible Interviewed billing expert (2) Probably yes, but there are Medicare requirements for scanners Radiologist/iCRO: PETX useful for clinical trials? Interviewed radiologist CTO (1) Could be (s:ll gegng mixed results) Interest in pre-‐surgery staging Interviewed surgeon (2) Confirmed interest; also affirmed poten:al for assessment Easy integra:on into clinical workflow Interviewed clinical manager (2) PETX similar to other add-‐on procedures Guidance for balancing resources between spinout and univ. Interviewed experienced spin-‐out entrepreneur (2) Address customers’ obstacles to adop:ng PETX; Confirmed important nego:a:ons with univ.

- 15. Week 10: Validated the product – market fit

- 16. Aer Week 10: More Financial Details Hypothesis Experiment (n) Results ROI in 5 years Interviewed Exec. Directors of Radiology (3) For mid-‐range capital expenses ROI expected in ~3 years, but varies by Org size Must have ROI Price Interviewed Exec. Directors of Radiology (2) Not all capital equip has to show a profit if it brings in revenue in subsequent/other services. Technical sales staff could assist with supported RD Interviewed Principal Engineer (1) Tech. sales staff (2) Must keep separate so that cost of clinical studies are not subtracted from system cost by Medicare. Margins on sales of capital equipment is lower than small device margins Interviewed Tech. sales reps (2 lrg 2 small companies) (4) Hard to get concrete numbers, but confirmed it was typically less than 65%. Purchase decision based solely on net clinic reimbursement. Interviewed Exec Dir Rad (1) Apending Physicians (4) Breast Cancer is an emo:onally charged topic. Huge pa:ent advocacy pressure can drive purchase decision even at net loss.

- 17. PET/X • Sales • Service Hospital or Clinic using PET/X Pa:ent Imaging physician CMS Insurance Capital equipment decision influencers Breast cancer advocacy groups Larger Medical Imaging company Capital equipment Decision makers Imaging Technologist Referring Oncologist NCCN other guidelines Finances opera:ons revenue stream purchase decision influence or control FDA Crux of the issue: Purchase

- 18. Imaging Site Revenue Model

- 19. PET/X – Sales Revenue Model # Pa:ents/year Reimbursement CPT code 7811 Shared Purchase Fee for Service 3yr Clinic Purchase ROI No 4yr ROI No 5yr ROI Yes Yes Unlikely to buy # Scan Opera:on Cost No Yes Direct sell price Cost of Goods Personnel Sales RD Profit GA Training Amor:zed Cost :me Cost of Goods Sales RD Profit GA Personnel Training Sales RD GA Training Profit Cost of Goods Personnel Profit

- 20. Income, Finance and Opera:ons Timeline Ac.vity/Item Year 1 Year 2 Year 3 Scanner Sales 2 4 8 Price per scanner $650K $650K $650K Service Income 0 20% of prior sales 20% of prior sales Total Revenues $1.30M $2.86M $5.98M Cost of Goods / scanner $195K $203K $211K Personnel / scanner $235K $183K $143K Sales / scanner $50K $40K $30K Training / scanner $50K $40K $35K RD 0 5% of Y1 revenue 5% of Y2 revenue GA $200K $220K $242K Total Expenses $1.26M $2.23M $3.89M Net $40K $633K $2.09M Cumula.ve Net $40K $673K $2.76M

- 21. Medical Device Investment Readiness Level Plausible exit Cash to exit Unit economics Validated Reimbursement Regulatory Intellectual Property Aprac:ve solu:on ID of MVP Compelling clinical need + large mkt Effec:ve team? 3.5 4.5 IRL 7 IRL 6 Oct 10 Dec 10 discovered data

- 22. Road to first sale We now have • Defined customer sub-‐segment: therapy imaging centers for invasive breast cancer • Ini:al marke:ng informa:on financial models • Validated preferred exit (licensing) • Submiped a Phase II using materials from I-‐Corps on valida:on of product-‐market fit and financial models Next we will • Complete MVP • Partner with luminary sites • Collect disseminate quality data

- 24. ! #$% # ! '()*+# ,----+# ! . ),/ # 0-/ # 1 #

- 25. *

- 26. # * 2 + 3 . # 4

- 27. 4+5 6 7 ! 8 ! 67 9

- 28. :

- 29. # 6 ;

- 30. * 4+5 # * = *

- 31. ;

- 32. 4+5 $ *# ! *

- 33. Week 1

- 34. !

- 35. #$ !% ' ! # ! ' ( ) #

- 36. ! *

- 37. + ,-./0! $ 122220! # .13 ! 423 !$ 5-12) 0! ,622% 7 !

- 38. / $

- 39. ! / '8 0 5 ! +

- 40. '+09 1-2) : ; # ( # :;

- 41. =

- 42. ! :

- 43. '+09 ! ? / @$ /

- 44. '+09 % /! # $ /

- 45. Week 2

- 46. ! !

- 47. #

- 48. $ % ! !' ( ) $ ( ( $ * +

- 49. ( ,

- 50. - .

- 51. (

- 52. % /01%2( ' 344442( # 135 ( 645 (' 7034+ 2( # /844 9 (

- 53. % '

- 54. ( % $: 2 7 # ( -

- 55. $-2; ' ( )'%( $- 304+ . %

- 56. $- = * = ! = ?

- 57. ! @

- 58. ( = A

- 59. $-2; ( % .' %

- 60. A

- 61. $-2; %( ' %

- 62. Week 3

- 63. ! ! # $

- 64. #

- 65. % ! !'( $ ) % $ ' ## $ % * + '

- 66. $ ,

- 67. - .

- 68. $ #

- 69. # # /012$ ( # 344442$ ' 135 $ 6034+ 2$ 745 $( # # /844 9# $

- 70. (

- 71. $ %: 2 6 $ -

- 72. %-2; '( $ )($ %- 304+ .

- 73. # %- =# ' * ' = ! = # ?

- 74. ! @

- 75. $ = A

- 76. %-2; # $ .(

- 77. A

- 78. %-2; # $ # # ' # (

- 79. # Week 4

- 80. ! ! # $

- 81. % ! !'( $ ) % $ ' ## $ % * + '

- 82. $ ,

- 83. - .

- 84. $ #

- 85. # # /012$ ( # 344442$ ' 135 $ 6034+ 2$ /744 - $( * 8# $

- 86. (

- 87. $ %9 2 6 $

- 88. %-2: ;'( $ )($ %- 304+ .

- 89. # %- # = ' * ' ! = # $ )8.

- 90. ! ?

- 91. $ @

- 92. %-2: # $ ; .(

- 93. @

- 94. %-2: # $ # # ' # (

- 95. # Week 5

- 96. ! ! # $

- 97. % ! !'( $ ) % $ ' ## $ % * + '

- 98. $ ,

- 99. - .

- 100. $ #

- 101. # # /012$ ( # 344442$ ' 135 $ 6034+ 2$ /744 - $( * 8# $

- 102. (

- 103. $ %9 2 6 $

- 104. %-2: ;'( $ )($ %- 304+ .

- 105. # %- # = ' * ' ! = # $ )8.

- 106. ! ?

- 107. $ @

- 108. %-2: # $ ; .(

- 109. @

- 110. %-2: # $ # # ' # (

- 111. # Week 6

- 112. ! ! # $

- 113. % ! !'( $ ) % $ ' ## $ % * + '

- 114. $ ,

- 115. - .

- 116. $ #

- 117. # # /012$ ( # 344442$ ' 135 $ 6034+ 2$ /744 - $( * 8# $

- 118. (

- 119. $

- 120. # %9 2 6 $

- 121. %-2: ;'( $ )($ %- 304+ .

- 122. # %- # = ' * ' ! = # $ )8.

- 123. ! ?

- 124. $ @

- 125. %-2: # $ ; .(

- 126. @

- 127. %-2: # $ # # ' # (

- 128. # Week 7

- 129. ! ! # $

- 130. % ! !'( $ ) % $ ' ## $ % * + '

- 131. $ ,

- 132. - .

- 133. $ #

- 134. # # /012$ ( # 344442$ ' 135 $ 6034+ 2$ /744 - $( * 8# $

- 135. (

- 136. $

- 137. # %9 2 6 $

- 138. %-2: ;'( $ )($ %- 304+ .

- 139. # %- # = ' * ' ! = # $ )8.

- 140. ! ?

- 141. $ @

- 142. %-2: # $ ; .(

- 143. @

- 144. %-2: # $ # # ' # (

- 145. # Week 8

- 146. ! ! # $

- 147. % ! !'( $ ) % $ ' ## $ % * + '

- 148. $ ,

- 149. - .

- 150. $ #

- 151. # # /012$ ( # 344442$ ' 135 $ 6034+ 2$ /744 - $( * 8# $

- 152. (

- 153. $

- 154. # %9 2 6 $

- 155. %-2: ;'( $ )($ %- 304+ .

- 156. # %- # = ' * ' ! = # $ )8.

- 157. ! ?

- 158. $ @

- 159. %-2: # $ ; .(

- 160. @

- 161. %-2: # $ # # ' # (

- 162. # Week 9

- 163. ! ! # $

- 164. % ! !'( $ ) % $ ' ## $ % * + '

- 165. $ ,

- 166. - .

- 167. $ #

- 168. # # /012$ ( # 344442$ ' 135 $ 6034+ 2$ /744 - $( * 8# $

- 169. (

- 170. $

- 171. # %9 2 6 $

- 172. %-2: ;'( $ )($ %- 304+ .

- 173. # %- # = ' * ' ! = # $ )8.

- 174. ! ?

- 175. $ @

- 176. %-2: # $ ; .(

- 177. @

- 178. %-2: # $ # # ' # (

- 179. # Week 10

- 181. Week 10 Drilling down on details

- 182. Customer types Interviewed Type (subtype) n Medical Oncologist 6 Surgeons 3 Imaging Physicians 23 Nuc Med Imaging 12 Mammo Imaging 4 Diagnos;c Imaging 3 Rheumatology 2 Technologists 6 mammo 4 nuc med 2 Pharma 4 RD 2 Exec 2 Type (subtype) n Radiology / Hospital 5 business execu:ves Regulatory 5 Reimbursement/coding 1 IP Lawyer 1 Health Economist 1 Imaging Scien:st 7 Sta:s:cian 1 Clinical Physicist 10 Imaging industry 33 Sales/marke;ng 9 rd, CTO 9 execu;ves 12 compe;ng 3