Section 6 revision

- 1. 1

- 2. Principles Of Accounting (1) Revision From Chapter 1 to Chapter 4 Mohamed Mahmoud mmahmoud@eelu.edu.eg Tel: (+202) 33318449 2

- 3. Correcting Entries The following errors were discovered after the transactions had been journalized and posted. Prepare the correcting entries. 1. A collection on account from a customer was recorded as a debit to Cash and a credit to Service Revenue for $780. Incorrect Cash 780 entry Service revenue 780 Cash 780 Correct entry Accounts receivable 780 Correcting Service revenue 780 entry Accounts receivable 780 3

- 4. Correcting Entries (continued) The following errors were discovered after the transactions had been journalized and posted. Prepare the correcting entries. 2. The purchase of supplies on account for $1,570 was recorded as a debit to Store Supplies and a credit to Accounts Payable for $1,750. Incorrect Store Supplies 1,750 entry Accounts payable 1,750 Store Supplies 1,570 Correct entry Accounts payable 1,570 Correcting Accounts payable 180 entry Store Supplies 180 4

- 5. Exercise 1 M. El-Beheery, CPA, was asked by Omar to review the accounting records and prepare the financial statements for his upholstering shop. Elbeheery reviewed the records and found three errors. 1. Cash paid on accounts payable for $930 was recorded as a debit to Accounts Payable $390 and a credit to Cash $390. 2. The purchase of supplies on account for $500 was debited to Equipment $500 and credited to Accounts Payable $500. 3. Omar withdrew $1,200 of cash and the bookkeeper debited Accounts Receivable for $120 and credited Cash $120. Instructions: Prepare an analysis of each error showing the (a) incorrect entry. (b) correct entry. (c) correcting entry. 5

- 6. Answer 1. (a) Incorrect Entry: Accounts Payable.............................................................. 390 Cash ......................................................................... 390 (b) Correct Entry: Accounts Payable.............................................................. 930 Cash ......................................................................... 930 (c) Correcting Entry: Accounts Payable.............................................................. 540 Cash ......................................................................... 540 2. (a) Incorrect Entry: Equipment ......................................................................... 500 Accounts Payable..................................................... 500 (b) Correct Entry: Supplies............................................................................. 500 Accounts Payable..................................................... 500 (c) Correcting Entry: Supplies............................................................................. 500 Equipment ................................................................ 500 6

- 7. Answer 3. (a) Incorrect Entry: Accounts Receivable......................................................... 120 Cash ......................................................................... 120 (b) Correct Entry: Omar, Drawing ................................................................ 1,200 Cash ......................................................................... 1,200 (c) Correcting Entry: Omar, Drawing ................................................................ 1,200 Accounts Receivable ................................................ 120 7

- 8. Exercise 2 Barone’s Repair Shop was started on May 1 by Nancy. Prepare a tabular analysis of the following transactions for the month of May: 1) Invested $10,000 cash to start the repair shop. 2) Purchased equipment for $5,000 cash. 3) Paid $400 cash for May office rent. 4) Received $5,100 from customers for repair service. 5) Withdrew $1,000 cash for personal use. 6) Paid part-time employee salaries of $2,000. 7) Incurred $250 of advertising costs, on account. 8) Provided $750 of repair services on account. 9) Collected $120 cash for services previously billed. Instructions : Prepare a tabular analysis of May transactions , the column headings should be as follows : cash + accounts receivable + equipment = Notes payable + Barone, Capital .

- 9. Answer Barone’s Repair Shop was started on May 1 by Nancy. Prepare a tabular analysis of the following transactions for the month of May. 1. Invested $10,000 cash to start the repair shop. Assets Liabilities Equity Accounts Accounts Barone, Cash + Receivable + Equipment = Payable + Capital 1. +10,000 +10,000 Investment

- 10. Answer 2. Purchased equipment for $5,000 cash. Assets Liabilities Equity Accounts Accounts Barone, Cash + Receivable + Equipment = Payable + Capital 1. +10,000 +10,000 Investment 2. -5,000 +5,000

- 11. Answer 3. Paid $400 cash for May office rent. Assets Liabilities Equity Accounts Accounts Barone, Cash + Receivable + Equipment = Payable + Capital 1. +10,000 +10,000 Investment 2. -5,000 +5,000 3. -400 -400 Expense

- 12. Answer 4. Received $5,100 from customers for repair service. Assets Liabilities Equity Accounts Accounts Barone, Cash + Receivable + Equipment = Payable + Capital 1. +10,000 +10,000 Investment 2. -5,000 +5,000 3. -400 -400 Expense 4. +5,100 +5,100 Revenue

- 13. Answer 5. Withdrew $1,000 cash for personal use. Assets Liabilities Equity Accounts Accounts Barone, Cash + Receivable + Equipment = Payable + Capital 1. +10,000 +10,000 Investment 2. -5,000 +5,000 3. -400 -400 Expense 4. +5,100 +5,100 Revenue 5. -1,000 -1,000 Drawings

- 14. Answer 6. Paid part-time employee salaries of $2,000. Assets Liabilities Equity Accounts Accounts Barone, Cash + Receivable + Equipment = Payable + Capital 1. +10,000 +10,000 Investment 2. -5,000 +5,000 3. -400 -400 Expense 4. +5,100 +5,100 Revenue 5. -1,000 -1,000 Drawings 6. -2,000 -2,000 Expense

- 15. Answer 7. Incurred $250 of advertising costs, on account. Assets Liabilities Equity Accounts Accounts Barone, Cash + Receivable + Equipment = Payable + Capital 1. +10,000 +10,000 Investment 2. -5,000 +5,000 3. -400 -400 Expense 4. +5,100 +5,100 Revenue 5. -1,000 -1,000 Drawings 6. -2,000 -2,000 Expense 7. +250 -250 Expense

- 16. Answer 8. Provided $750 of repair services on account. Assets Liabilities Equity Accounts Accounts Barone, Cash + Receivable + Equipment = Payable + Capital 1. +10,000 +10,000 Investment 2. -5,000 +5,000 3. -400 -400 Expense 4. +5,100 +5,100 Revenue 5. -1,000 -1,000 Drawings 6. -2,000 -2,000 Expense 7. +250 -250 Expense 8. +750 +750 Revenue

- 17. Answer 9. Collected $120 cash for services previously billed. Assets Liabilities Equity Accounts Accounts Barone, Cash + Receivable + Equipment = Payable + Capital 1. +10,000 +10,000 Investment 2. -5,000 +5,000 3. -400 -400 Expense 4. +5,100 +5,100 Revenue 5. -1,000 -1,000 Drawings 6. -2,000 -2,000 Expense 7. +250 -250 Expense 8. +750 +750 Revenue 9. +120 -120 6,820 + 630 + 5,000 = 250 + 12,200

- 18. Exercise 3 Transactions for Salem Company for the month of October are presented below. 1. Oct 1. Invested an additional $40,000 cash in the business. 2. Oct 3. Purchased land costing $28,000 for cash. 3. Oct 9. Purchased equipment costing $12,000 for $3,000 cash and the remainder on credit. 4. Oct 13. Purchased supplies on account for $800. 5. Oct 17. Paid $1,000 for a one-year insurance policy. 6. Oct 22. Received $3,000 cash for services performed. 7. Oct 25. Received $4,000 for services previously performed on account. 8. Oct 28. Paid wages to employees for $2,500. 9. Oct 31. Salem withdrew $1,000 cash from the business. Instructions Journalize each transaction and post to the ledger accounts.

- 19. Answer 1. Oct 1. Invested an additional $40,000 cash in the business. 2. Oct 3. Purchased land costing $28,000 for cash. 3. Oct 9. Purchased equipment costing $12,000 for $3,000 cash and the remainder on credit. Oct.1 Cash ......................................................................................... 40,000 E. Petry, Capital...................................................................... 40,000 Oct.3 Land ......................................................................................... 28,000 Cash ....................................................................................... 28,000 Oct.9 Equipment ................................................................................ 12,000 Cash ....................................................................................... 3,000 Accounts Payable................................................................... 9,000

- 20. Answer 4. Oct 13. Purchased supplies on account for $800. 5. Oct 17. Paid $1,000 for a one-year insurance policy. 6. Oct 22. Received $3,000 cash for services performed. Oct.13 Supplies .......................................................................................... 800 Accounts Payable .................................................................. 800 Oct.17 Prepaid Insurance ......................................................................... 1,000 Cash .................................................................................. 1,000 Oct.22 Cash .............................................................................................. 3,000 Service Revenue ................................................................ 3,000

- 21. Answer 7. Oct 25. Received $4,000 for services previously performed on account. 8. Oct 28. Paid wages to employees for $2,500. 9. Oct 31. Salem withdrew $1,000 cash from the business. Oct.25 Cash............................................................................................. 4,000 Accounts Receivable........................................................... 4,000 Oct.28 Wages Expense........................................................................... 2,500 Cash................................................................................... 2,500 Oct.31 E. Petry, Drawing ....................................................................... 1,000 Cash................................................................................... 1,000

- 22. 1. Cash ................................................................................................ 40,000 E. Petry, Capital...................................................................... 40,000 2. Land ................................................................................................ 28,000 Cash ....................................................................................... 28,000 3. Equipment ....................................................................................... 12,000 Cash ....................................................................................... 3,000 Accounts Payable................................................................... 9,000 4. Supplies .......................................................................................... 800 Accounts Payable .................................................................. 800 5. Prepaid Insurance ........................................................................... 1,000 Cash ....................................................................................... 1,000 6. Cash ................................................................................................ 3,000 Service Revenue .................................................................... 3,000 7. Cash................................................................................................. 4,000 Accounts Receivable............................................................... 4,000 8. Wages Expense............................................................................... 2,500 Cash........................................................................................ 2,500 9. E. Petry, Drawing ............................................................................. 1,000 Cash........................................................................................ 1,000

- 23. Answer Posting to ledger Dr. Accounts Payable Cr. Dr. Service revenue Cr. Oct.9 9000 Oct.22 3000 Oct.13 800 Balance 3000 Balance 9800 Dr. Cash Cr. Oct.1 40000 Oct.3 28000 Dr. Account receivable Cr. Oct.25 4000 Oct.22 3000 Oct.9 3000 Oct.25 4000 Oct.17 1000 Oct.28 2500 Oct. 31 1000 Balance 4000 Balance 11500

- 24. Exercise 4 Prepare adjusting entries for the following transactions. Omit explanations 1) Depreciation on equipment is $800 for the accounting period. 2) There was no beginning balance of supplies and purchased $500 of office supplies during the period. At the end of the period $80 of supplies were on hand. 3) Prepaid rent had a $1,000 normal balance prior to adjustment. By year end $600 was unexpired.

- 25. Answer 1) Depreciation Expense...................................................................... 800 Accumulated Depreciation—Equipment.................................. 800 2) Supplies Expense ............................................................................ 420 Supplies .................................................................................. 420 ($500 – $80) 3) Rent Expense................................................................................... 400 Prepaid Rent ........................................................................... 400 ($1,000 – $600) 25

- 26. Exercise 5 B. Hans Albert Enterprises purchased computer equipment on May 1, 2009 for $4,500. The company expects to use the equipment for 3 years. What adjusting journal entry should the company make at the end of each month if monthly financials are prepared (annual depreciation is $1,500)? What is the book value of the equipment at May 31, 2009? Answer Depreciation Expense ........................................................... 125 Accumulated Depreciation............................................... 125 2. Cost $4,500 Accumulated Depreciation (125) Book value $4,375

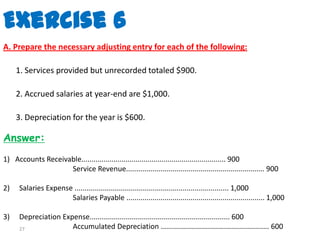

- 27. Exercise 6 A. Prepare the necessary adjusting entry for each of the following: 1. Services provided but unrecorded totaled $900. 2. Accrued salaries at year-end are $1,000. 3. Depreciation for the year is $600. Answer: 1) Accounts Receivable........................................................................ 900 Service Revenue..................................................................... 900 2) Salaries Expense ............................................................................. 1,000 Salaries Payable ..................................................................... 1,000 3) Depreciation Expense...................................................................... 600 27 Accumulated Depreciation ...................................................... 600

- 28. Exercise 7 The following information is available for Amr Company for the year ended December 31, 2008: Accounts payable $2,700 Accumulated depreciation, equipment 4,000 Amr, Capital 7,800 Intangible assets 2,500 Notes payable (due in 5 years) 7,500 Accounts receivable 1,500 Cash 2,600 Short-term investments 1,000 Equipment 7,500 Long-term investments 6,900 Instructions: Use the above information to prepare a classified balance sheet for the year ended December 31, 2009. 28

- 29. Answer Amr COMPANY Balance Sheet For the Year Ended December 31, 2009 Assets Current Assets Cash $2,600 Short-term investments 1,000 Accounts receivable 1,500 Total Current Assets $5,100 Investments Long-term investments 6,900 Property, Plant, and Equipment Equipment 7,500 Less Accumulated depreciation, equipment 4,000 3,500 Intangible assets 2,500 Total Assets $18,000 Liabilities and Owner’s Equity Current Liabilities Accounts payable $2,700 Long-term liabilities Notes payable 7,500 Total Liabilities $10,200 Owner’s equity Amr, Capital 7,800 Total owner’s equity 7,800 Total liabilities and owner’s equity $18,000 29

- 30. 30

- 31. 31