Sending Your Child to College

- 1. Investment advisory products and services are made available through Ameriprise Financial Services, Inc., a registered investment adviser. Ameriprise Financial Services, Inc. Member FINRA and SIPC. © 2009-2015 Ameriprise Financial, Inc. All rights reserved. Sending your child to college Gerrilee Hartman Financial Advisor Skillrud Financial Group A financial advisory practice of Ameriprise Financial Services, Inc. May, 20th 2016

- 2. Why are you willing to risk the investment? Source: Bureau of Labor and Statistics U.S. Department of Labor. USUAL WEEKLY EARNINGS OF WAGE AND SALARY WORKERS, FOURTH QUARTER 2014. Data on chart is annualized. $34,528 $63,648 $72,852 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 High school only Bachelor's degree only Advanced degree Annual median income for workers over age 25 2014 (Q4)

- 3. Defining your goal What investment options are available? Which type of school will you and your child select? How much will it cost? How much are you willing to pay? What sources of aid are available?

- 4. $3,347 $9,139 $22,958 $31,231 $7,705 $9,804 $9,804 $11,188 2-yr. public 4-yr. public in-state 4-yr. public out-of-state 4-yr. private Tuition & fees Room & board Books & supplies Transportation Other Annual cost of college by type 2014-2015 average estimated undergraduate costs $16,325 $23,410 $37,229 $46,272 Source: Source: Trends in College Pricing. © 2014 The College Board. www.collegeboard.org

- 5. Are there ways to lower the cost? • A later start • Community college • Living at home • Less expensive school • Child contributes • State residency • A vocational degree • An alternate path Consider

- 6. Other financial considerations Your child does not attend college Divorce Blended family Small business ownership and partners Shared custody Current K-12 tuition

- 7. How much are you willing to pay?

- 8. How much should you save? Neither Ameriprise Financial nor its affiliates or representatives may provide tax advice. Consult your tax advisor or attorney regarding specific tax issues. • Timing • Risk tolerance • Amount needed • Ability to save • Taxes Important factors

- 9. Federal financial aid (2013-2014) National distribution* Grants $8,080 Federal loans $4,840 Other $1,260 Average aid per recipient* $14,180 Total *Source: Trends in Student Aid. © 2014 The College Board. www.collegeboard.org 1% 6% 5% 7% 8% 21% 18% 34% Federal work-study Private & employer grants State grants Other federal grant programs Tax credits & deductions Institutional grants Pell grants Federal loans

- 10. Free Application for Federal Student AidSM (FAFSA) The federal financial aid application process Source: Free Application for Federal Student AidSM − www.fafsa.ed.gov FAFSA to-do list Find form at www.fafsa.ed.gov Apply Apply early Avoid mistakes Answer every question Apply annually

- 11. Expected Family Contribution (EFC) The federal financial aid application process Factors • Your money • Your child’s money • Number of children • Number of children in college • Age of oldest parent • Unusual family circumstances • Unemployment Source: Free Application for Federal Student AidSM − www.fafsa.ed.gov Cost of attendance – Expected family contribution Financial need Formula

- 12. Pay less than “sticker price?” The federal financial aid application process Source: Free Application for Federal Student AidSM − www.fafsa.ed.gov Public university Private university Annual cost of attending $20,000 $40,000 EFC $10,000 $10,000 Financial need or aid $10,000 $30,000 FAFSA/EFC Example — Expected Family Contribution (EFC) remains constant

- 13. EFC — what is included in the calculation? The federal financial aid application process Included in calculation • Custodial parent & custodial stepparent income • Custodial parent & custodial stepparent assets such as: – Trusts – Stocks, bonds, mutual funds, CDs – Savings/checking • Student’s income & assets including EE savings bonds Not included in calculation • Income of non-custodial parent • Scholarships • Tax credits for educational expenses • Home/farm equity • Retirement plans • Annuities • Life insurance policies Source: Free Application for Federal Student AidSM − www.fafsa.ed.gov FAFSA/EFC

- 14. EFC — assessing the family’s assets The federal financial aid application process Owner name Savings Assessment rate Expected contribution Kelly (Daughter) $10,000 20% $2,000 Karl (Dad) $10,000 5.6% $560 This scenario is shown for illustrative purposes only and does not represent actual clients. Actual client experiences will vary. Source: Free Application for Federal Student AidSM − www.fafsa.ed.gov Example — it may be better for money to be in a parent's name

- 16. Student loans Source: Trends in Student Aid. © 2014 The College Board.www.collegeboard.org Average 2012-2013 loan debt per borrower: $25,600 Types of loans • Direct Subsidized Loans • Direct Unsubsidized Loans • Direct PLUS Loans • Direct Consolidation Loans • Federal Perkins Loan Program • Private Education Loans

- 17. Direct subsidized & unsubsidized loans Terms Subsidized loans undergraduate Unsubsidized loans undergraduate Based on financial need Yes No Interest begins to accrue When borrower leaves school From the day the loan is made Annual loan limits (depending on grade level) $3,500 − $7,500 $9,500 − $20,500* Maximum total debt (aggregate loan limits) $23,000 $57,500 Interest rate** 4.66% 4.66% * Less any subsidized amount received for the same period. Loan limit also depends on year in school and dependency status. ** 2014 – 2015 Academic year is July 1, 2014 – June 30, 2015 www.studentaid.ed.gov

- 18. Parent PLUS loans Source: www.studentaid.ed.gov/types/loans/plus Overview • For parents of dependent children • Not granted based on need • Good credit history required • Fixed interest rate of 7.21% Loan limit calculation Cost of attendance – Other financial aid Loan limit

- 19. Perkins Loans Source: www.studentaid.ed.gov/types/loans Overview • Full and part-time students • Annual limits - Undergraduates $5,500 - Graduates $8,000 • 5% interest rate • Income-based repayment

- 20. Student loan repayment benefits Student loan interest deduction • Up to $2,500 deduction Forgiveness of eligible federal loans • Discharges debt after 10 years of full-time employment in certain public services • Visit www.studentaid.ed.gov Direct Consolidation loan program • Reduced monthly payments • One lender, one monthly payment • Varied deferment options www.studentaid.ed.gov/types/loans

- 21. Grants Gifts that generally do not have to be repaid Source: studentaid.ed.gov TEACH grants Federal Supplemental Education Opportunity Grants (FSEOG) Pell grants State grants Institutional grants Iraq and Afghanistan Service grant & the Post-911 GI Bill

- 22. Scholarships Where to look Scholarship search companies Internet School guidance office Employers Service organizations When to look Child’s junior year of high school

- 23. This example is for illustrative purposes only and does not represent actual clients. Actual client experiences will vary. Educational savings accounts & financial gifts versus Unexpected resultsGood intentions

- 24. Age* In 2015, the Kiddie Tax applies when the child’s: 0-17 • Investment income is over $2,100 18 • Investment income is over $2,100 • Earned income not greater than ½ of child’s total support 19-23 • Investment income is over $2,100 • Is a full-time student • Earned income not greater than ½ of child’s total support *Age at the end of the year Educational savings accounts & financial gifts

- 25. Control of money Tax benefits Important issues Financial aid eligibility Educational savings accounts & financial gifts UTMA/UGMA

- 26. Educational savings accounts & financial gifts Coverdell Education Savings Accounts

- 27. Educational savings accounts & financial gifts EE Savings Bonds (restrictions apply)

- 28. Clients should carefully consider the investment objectives, risks, charges, and expenses associated with a 529 Plan before investing. More information regarding a particular 529 Plan is available in the issuer’s official statement, which may be obtained from an Ameriprise Financial advisor. Investors should read the 529 Plan’s official statement carefully before investing. Clients contributing to a 529 Plan offered by a state in which they are not a resident, should consider, before investing, whether their, or their designated beneficiary(s) home state offers any state tax or other benefits only available for investments in such state’s qualified tuition program. Educational savings accounts & financial gifts 529 College Savings Plan

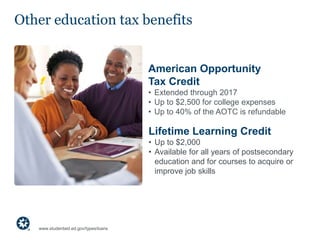

- 29. Other education tax benefits American Opportunity Tax Credit • Extended through 2017 • Up to $2,500 for college expenses • Up to 40% of the AOTC is refundable Lifetime Learning Credit • Up to $2,000 • Available for all years of postsecondary education and for courses to acquire or improve job skills www.studentaid.ed.gov/types/loans

- 30. Other funding ideas Private industry jobs Military ROTC Federal Work-study

- 32. Bankrupting your retirement How will financial aid be assessed? Are you willing to quit retirement? Are you at risk? What if the money isn’t spent on college? How important is retirement? How long can you work? Can you get a loan for retirement? Will you become financially vulnerable?

- 33. Individual investments Investment products, including shares of mutual funds, are not federally or FDIC-insured, are not deposits or obligations of, or guaranteed by any financial institution and involve investment risks including possible loss of principal and fluctuation in value. Certificates of deposit are FDIC-insured up to $250,000 per depositor. Stock investments have an element of risk. High-quality stocks may be appropriate for some investments strategies. Ensure that your investment objectives, time horizon and risk tolerance are aligned with stocks before investing, as they can lose value. There are risks associated with fixed income investments, including credit risk, interest rate risk, and prepayment and extension risk. In general, bond prices rise when interest rates fall and vice versa. This effect is usually more pronounced for longer-term securities.

- 34. Protecting your goal Cash value life insurance Before you purchase, be sure to ask your sales representative about the insurance policy’s features, benefits and fees, and whether the insurance is appropriate for you, based upon your financial situation and objectives.

- 35. Smart spending

- 36. Writing your life story Ameriprise Financial cannot guarantee future financial results. Client experiences may vary.

- 37. Ameriprise Financial Founded in 1894. Ameriprise Financial is America's leader in financial planning.1 More than 2 million individual, business and institutional clients.2 Ameriprise Financial has more than $800 billion in assets under management and administration.3 Ameriprise Financial maintains leadership positions in each of its four core business segments: Advice & Wealth Management, Asset Management, Annuities and Protection.4 Never taken a bailout.

- 38. The initial consultation provides an overview of financial planning concepts. You will not receive written analysis and/or recommendations. Complimentary Initial Consultation Beforehand, take the 3-Minute Confident RetirementSM check Map out your journey using the Confident Retirement approach Tell me about what’s important to you Learn about how I work with clients Determine if we’re a good match

- 39. Investment products, including shares of mutual funds, are not federally or FDIC-insured, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value. The Confident Retirement approach is not a guarantee of future financial results. Ameriprise Financial and its representatives do not provide tax or legal advice. Consult your tax advisor or attorney regarding specific tax issues. Investment advisory products and services are made available through Ameriprise Financial Services, Inc., a registered investment adviser. Ameriprise Financial Services, Inc. Member FINRA and SIPC. © 2015 Ameriprise Financial, Inc. All rights reserved. Important information