Writing Effective Suspicious Activity Reports (SARs): Start with WHY

- 1. https://www.alessa.caseware.com/ Writing Effective Suspicious Activity Reports: Start with WHY Laurie Kelly, CAMS

- 2. https://www.alessa.caseware.com/ 2 Alessa: Integrated AML Compliance Solution Customer Due Diligence Transaction Monitoring/ Screening Regulatory Reporting Sanctions Screening AML Capabilities Data Management, Workflows, Case Management, Fraud Detection & Prevention (Advanced Analytics) Traditional FIs FinTechs Gaming and Casinos MSBs Markets Questions? Email us at alessa@caseware.com

- 3. https://www.alessa.caseware.com/ Agenda 3 1. Background – Why SAR quality is critical 2. Who is reading your SAR? 3. How SARs make a difference 4. Write for your reader! 5. The Case Report – a valuable tool 6. Key Takeaways and Q & A

- 4. https://www.alessa.caseware.com/ 4 Staggering volume SARs filed with FinCEN in 2018 SARs filed every business day (2018) E-Filing began in July 2012

- 5. https://www.alessa.caseware.com/ 5 Data quality is critical Data value is driven by data quality Content and quality of a SAR is no different When we understand: • WHO is using the information, • For WHAT purpose, and • HOW it is obtained We can craft SARs to make them most effective in their ultimate purpose: fighting crime.

- 6. https://www.alessa.caseware.com/ 6 Who is reading your SAR? Majority of SARs are read by a person SAR Review Teams SAR ReviewTask Forces FinCEN’s data repository

- 7. https://www.alessa.caseware.com/ FinCEN Annual Awards Program: Recognizes importance of SAR, CTR reporting by financial institutions A few examples from the 2019 award-winning cases: • An illegal online bitcoin exchange - $60 million laundered • A fraud and trade-based money laundering scheme - $100 million laundered And an example from personal experience…a name in a fax header message 7 SARs make a difference “The cases recognized today make clear that BSA data is critical in the fight against financial crime.” Sigel Mandelker Undersecretary of the Treasury for Terrorism and Financial Intelligence

- 8. https://www.alessa.caseware.com/ If law enforcement is the SAR’s reader – write it for their greatest benefit • Supply the most critical information: Objective: The reader can quickly grasp the nature of the case, how much money is involved, who are the key players, and what are the nuances that make this suspicious. 8 Write for your reader Succinctly Clearly Logically

- 9. https://www.alessa.caseware.com/ Form fields, checkboxes and dropdown lists are important: • Captures foundational information (subjects’ information, type of activity) • Makes data capture and analysis more robust and granular • Should be used judiciously But the Narrative is key: • Grabs the reader’s attention • Describes the nuances • Use of keywords for data flagging 9 The Narrative is the key

- 10. https://www.alessa.caseware.com/ 10 Describe the Nuances • Repeat information already reflected in other parts of the form • Provide lengthy lists of transaction details • Use verbose language and/or passive tense, such as “in the amount of” or “for the benefit of” • Provide too little information • Summarize the activity, how it was detected, and why it’s suspicious in the first sentence (or two) • Describe elements not reflected in the names and numbers • Behavior or appearance • Comments made to bank personnel • Explain why activity is out-of-pattern • Explain any unusual transaction characteristics: amounts, timing, text messages on wire transfers • Use simple, concise, active tense Do: Don’t:

- 11. https://www.alessa.caseware.com/ Here is an example of a [fictitious] poorly written SAR narrative – can you spot the problems with it? 11 SAR Narrative Example First Federal Bank is filing this SAR in connection with possible suspicious payments to ABC Corporation originating from XYZ LLC. This review of the transactions that led to the filing of this SAR was prompted by an alert from the bank’s payment monitoring system for Century Bank concerning transfers on behalf of its client XYZ LLC. Century Bank is a correspondent-banking client of First Federal. First Federal records reveal that from June 29, 2019 to August 1, 2019, 4 payments totaling $13,675.21 were transmitted to ABC Corporation at Century Bank. ABC Corporation is being used to repatriate funds to Venezuela. As of March 2, 2019, ABC Corporation does not appear on FinCEN’s MSB registration list.

- 12. https://www.alessa.caseware.com/ 12 Now for a Better Version… Customer XYZ LLC, a local dry cleaner and laundry establishment, sent 4 outgoing wire transfers totaling $13,675.21 within a 4-week period to an account at Banco de Venezuela (Caracas office) to beneficiary ABC Corporation, an apparent Panama-based shell company. These payments are highly out-of-pattern for XYZ LLC, which has never sent or received a single wire transfer in its 8 year history with the bank. XYZ LLC is a cash-intensive business and high-risk customer for whom the bank closely monitors all transaction activity. ABC Corporation appears on Panama’s national Companies Registry with a physical address matching that of a law firm in Panama City used by hundreds of other legal entities, per the bank’s internet research. Mr. Roberto Alvarez (owner/sole member, XYZ LLC) has stated to bank personnel that the payments were for “purchases of cleaning supplies.” The payments did not include any explanatory messages such as invoice numbers or other references as to purpose. Complete transaction details are provided in the attachment to this SAR. Supporting documentation is available upon request.

- 13. https://www.alessa.caseware.com/ • Technically, “advisory key terms” • First requested by FinCEN in 2008 – “foreign corruption” • Now 21 different keywords listed – work them into the SAR narrative whenever applicable See FinCEN’s website: www.fincen.gov/suspicious-activity-report-sar-advisory-key-terms 13 Use Keywords to Help Data Mining Foreclosure rescue scam SKN passport Bankruptcy FHA MX restriction Tax refund fraud CREF BMPE Advisory human smuggling Payment processor IVTS TBML Advisory human trafficking Elder financial exploitation BEC fraud SIGTARP Funnel account Account takeover fraud EAC fraud HECM Foreign corruption

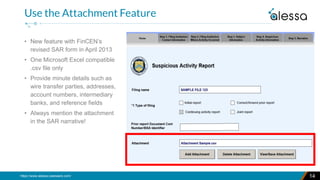

- 14. https://www.alessa.caseware.com/ • New feature with FinCEN’s revised SAR form in April 2013 • One Microsoft Excel compatible .csv file only • Provide minute details such as wire transfer parties, addresses, account numbers, intermediary banks, and reference fields • Always mention the attachment in the SAR narrative! 14 Use the Attachment Feature

- 15. https://www.alessa.caseware.com/ • Initial Report – “new” • Continuing activity report – more of the same FinCEN guidance: Each continuing activity SAR should include any new transactions occurring in a subsequent 90-day monitoring period since the most recent SAR filing. 15 New or Continuing Activity SAR?

- 16. https://www.alessa.caseware.com/ But…what happens when the activity reoccurs, but after the 90-day monitoring period ends? • No specific published FinCEN guidance • The examiners’ viewpoint • What makes the SAR most useful to law enforcement? 16 New or Continuing Activity SAR?

- 17. https://www.alessa.caseware.com/ • The SAR and narrative section capture the highlights of a suspicious activity case A suspicious activity case is so much more than checkbox categories, keywords and a summary. • “Additional details available upon request” is standard in most SAR narratives 17 “Additional Details Upon Request” What will you provide to law enforcement should they ask for these “additional details”?

- 18. https://www.alessa.caseware.com/ Benefits: • Allows the filing institution to quickly deliver on law enforcement’s request for a SAR case’s full details • Helps management, internal SAR Review Committee members, regulatory examiners and internal auditors understand the nuances of the case • Especially useful in continuing activity cases • Designed by the financial institution to meet its unique needs • May be templated and modified as needed • Facilitates preparing the SAR form and cross-checking/review 18 The Case Report – A Valuable Tool

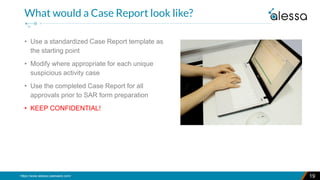

- 19. https://www.alessa.caseware.com/ 19 What would a Case Report look like? • Use a standardized Case Report template as the starting point • Modify where appropriate for each unique suspicious activity case • Use the completed Case Report for all approvals prior to SAR form preparation • KEEP CONFIDENTIAL!

- 20. https://www.alessa.caseware.com/ 20 Basic Case Report Sections (1) Section 2 - Detailed background information in narrative form • How suspicious activity was detected • What follow-up, research and/or customer inquiries were performed and by whom • What prompted the SAR filing • Background details about the customer and/or subjects involved • References to other SARs on same customer Section 1 - Basic reference information • Customer name • Date case opened • Category of suspicious activity (cross- referencing the SAR form categories, perhaps) • Case number

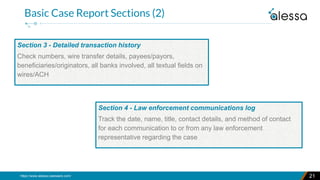

- 21. https://www.alessa.caseware.com/ 21 Basic Case Report Sections (2) Section 3 - Detailed transaction history Check numbers, wire transfer details, payees/payors, beneficiaries/originators, all banks involved, all textual fields on wires/ACH Section 4 - Law enforcement communications log Track the date, name, title, contact details, and method of contact for each communication to or from any law enforcement representative regarding the case

- 22. https://www.alessa.caseware.com/ 22 Basic Case Report Sections (3) Section 6 - SAR narrative: • Much easier to draft the SAR narrative outside of the form itself (or form- generating software • Final narrative verbatim in the Case Report allows others reviewing and/or approving to read the narrative along with all supporting information. Section 5 - SAR filing log • Tracking record to document all regulatory deadlines were met – especially important in ongoing cases • Record these dates for each SAR: Activity detected Decision to file SAR SAR filed Due date of next continuing activity SAR due date (120 days from date of last SAR) • BSA ID number for quick reference

- 23. https://www.alessa.caseware.com/ Question: Why the effort to create a standalone Case Report document when an automated suspicious activity monitoring/SAR case management system exists? Answer: What is the automated system’s level of detail and accessibility of SAR case data? A Case Report provides high value when an automated system: • Has limited capability to store freeform text notes; cannot print a full report of all notes entered • Does not retain the SAR narrative as a separate field • Cannot produce a summary report (with content like that of a Case Report) which can be provided to law enforcement, internal management, or examiners/auditors • Cannot maintain specific records of law enforcement communications 23 The Case Report vs. Automated Environment

- 24. https://www.alessa.caseware.com/ • SARs are the ultimate reason for an anti-money laundering program. • Their primary purpose: to deliver information to law enforcement promptly, concisely and meaningfully. 24 Conclusion: Remember the “Why” “BSA reports filed by our financial institutions provide some of the most important information available to law enforcement and other agencies safeguarding the United States. […] The reporting aids in expanding the scope of ongoing investigations by pointing to the identities of previously unknown subjects, exposing accounts and hidden financial relationships, or revealing other information such as common addresses or phone numbers that connect seemingly unrelated participants in a criminal or terrorist organization and, in some cases, even confirming the location of suspects.” FinCEN Director Jennifer Shasky Calvery

- 25. https://www.alessa.caseware.com/ 25 Conclusion: Remember the “Why” “The work we do [as AML professionals] impacts all aspects of society, because economic effects have the potential to harm or help all strata throughout the world. We are charged with detecting, reporting, and preventing the misuse of monies (or value of any kind) that furthers crime in any fashion. The system that surrounds our requirements is by no means perfect. We should do all we can to improve it.” John Byrne, Senior Advisor to the Advisory Board of ACAMS and Vice-Chairman of AML RightSource

- 26. https://www.alessa.caseware.com/ • Your SAR will be read, so write for your reader – Law Enforcement • Describe the nuances not reflected in the checkboxes and fill-in fields • Make your narrative clear, concise, and logical • Know FinCEN’s keywords and use them whenever applicable • Use the attachment feature • Distinguish “new” vs. “continuing activity” reports as it makes most sense • Explore using a Case Report for comprehensive supporting documentation • SARs make a tremendous impact on fighting crime 26 Recap – Key Takeaways

- 27. https://www.alessa.caseware.com/ Writing Effective Suspicious Activity Reports: Start with WHY Laurie Kelly, CAMS

![https://www.alessa.caseware.com/

Here is an example of a [fictitious] poorly written SAR narrative – can you spot the problems

with it?

11

SAR Narrative Example

First Federal Bank is filing this SAR in connection with possible suspicious payments to

ABC Corporation originating from XYZ LLC. This review of the transactions that led to the

filing of this SAR was prompted by an alert from the bank’s payment monitoring system

for Century Bank concerning transfers on behalf of its client XYZ LLC. Century Bank is a

correspondent-banking client of First Federal. First Federal records reveal that from June

29, 2019 to August 1, 2019, 4 payments totaling $13,675.21 were transmitted to ABC

Corporation at Century Bank. ABC Corporation is being used to repatriate funds to

Venezuela. As of March 2, 2019, ABC Corporation does not appear on FinCEN’s MSB

registration list.](https://image.slidesharecdn.com/webinarsarwritingfinalslideshare-191204140320/85/Writing-Effective-Suspicious-Activity-Reports-SARs-Start-with-WHY-11-320.jpg)

![https://www.alessa.caseware.com/

• SARs are the ultimate reason for an anti-money laundering program.

• Their primary purpose: to deliver information to law enforcement promptly, concisely and

meaningfully.

24

Conclusion: Remember the “Why”

“BSA reports filed by our financial institutions provide some of the most important

information available to law enforcement and other agencies safeguarding the United

States. […] The reporting aids in expanding the scope of ongoing investigations by

pointing to the identities of previously unknown subjects, exposing accounts and hidden

financial relationships, or revealing other information such as common addresses or

phone numbers that connect seemingly unrelated participants in a criminal or terrorist

organization and, in some cases, even confirming the location of suspects.”

FinCEN Director Jennifer Shasky Calvery](https://image.slidesharecdn.com/webinarsarwritingfinalslideshare-191204140320/85/Writing-Effective-Suspicious-Activity-Reports-SARs-Start-with-WHY-24-320.jpg)

![https://www.alessa.caseware.com/ 25

Conclusion: Remember the “Why”

“The work we do [as AML professionals] impacts all aspects of society, because economic

effects have the potential to harm or help all strata throughout the world. We are

charged with detecting, reporting, and preventing the misuse of monies (or value of any

kind) that furthers crime in any fashion. The system that surrounds our requirements is

by no means perfect. We should do all we can to improve it.”

John Byrne, Senior Advisor to the Advisory Board of ACAMS

and Vice-Chairman of AML RightSource](https://image.slidesharecdn.com/webinarsarwritingfinalslideshare-191204140320/85/Writing-Effective-Suspicious-Activity-Reports-SARs-Start-with-WHY-25-320.jpg)