Jordan Rohan

- 1. Recent Thoughts on Digital Media Jordan Rohan Clearmeadow Partners Presentation to the DPA Conference October 28, 2008

- 2. What Have I Been Up To? Started Clearmeadow Partners , a digital media advisory firm Firm’s mission: to help companies of all sizes accelerate growth in digital revenue Profitable companies with defensible market positions Advisory services, capital raising, and business development services Want to chat? [email_address] June 6, 2009

- 3. Review of Macro Trends Slow Decline of Portals Publisher Perspective: Ceding control of content is unfortunate but necessary The New Rules of an Uncertain Market Recession is bigger than you are Fundamentals are no match for forced selling The bottom will happen when you stop looking for it Tips for Survival June 6, 2009 Agenda

- 4. U.S. Market Averages Down ~40% in last 12 months….down 33% since June DPAC June 6, 2009 A rally of 66% required to get back to even! June 25th DPAC

- 5. Since the last DPAC in June……. Public Markets Have Re-Valued Internet June 6, 2009 The “High-Growth” Internet has not been spared

- 6. June 6, 2009 Trio of macro issues: Liquidity: Corporate debt spreads reflect unwillingness to lend DE-flation: Real estate revaluation De-leveraging Global Central Bank actions: Will it help? When will it help? Review of Macro Trends: Economic Recession…..

- 7. June 6, 2009 Inflation is no longer a concern….it’s deflation now Central Banks liquidity injections have yet to be felt Libor has eased slightly Corporate balance sheets (excluding financials) are generally healthy U.S. corporations do not have a glut of inventories U.S. new homes sales unexpectedly rose slightly (2.7%) in Sept vs. August – Dept of Commerce Review of Macro Trends: There are some positives…..

- 8. Positives: Strong dollar, falling energy Three month trends show startling reversal of dollar/euro valuation as investors seek safe haven in uncertain times Global recession leads to supply glut in oil, reduced demand for ethanol (corn) and basic materials Gas prices down $0.53 in last 2 weeks to $2.78/gal nationally June 6, 2009 OIL US$/Euro June 25th DPAC

- 9. Positives: Food and energy prices lower Global slowdown, reduced speculation results in lower agriculture and base metals Commodities down 45% since DPAC in June June 6, 2009 June 25th DPAC

- 10. June 6, 2009 Banks still not lending enough Home prices have not stabilized Industrial production slowing Retail sales softening Unemployment rate will continue to rise Capital markets under severe selling pressures Nothing is safe: Gold and Utilities have fallen as well, which is unusual in low interest rate environment Review of Macro Trends: The Bad News…..

- 11. Negatives: Real Estate Revaluation It may take a few more years Revaluation matters more for investors, speculators than those who own-and-occupy homes Most severe in areas with greatest speculation including FL, CA Even within those states, some areas not seeing major revaluation Neighborhood-by-neighborhood analysis required In areas of less impact, headlines worse than reality Secondary impact: Headlines impacting consumer confidence and spending levels, which are impacting confidence of would-be borrowers June 6, 2009 -> SLOW & STEADY IMPACT ON AD SPEND Source: Case-Schiller Index

- 12. Negatives: Real Estate Revaluation …New York City is not immune either…. Case-Schiller reporting NYC down 7.4% y/y vs. National Average of down 17.5% in Month of July June 6, 2009 National Average NYC Source: Case-Schiller Index

- 13. Negatives: Corporate Debt Spreads Remain Massively Wide June 6, 2009

- 14. Negatives: Consumer tightening Preferring Walmart over Tiffany and Nordstrom June 6, 2009 Walmart

- 15. Negatives: Cutting back on casual dining Preferring McDonalds over Cheesecake Factory, PF Chang’s and Ruth Chris June 6, 2009 McDonald’s

- 16. The Rules of an Uncertain Market The financial markets will do their best to cause the maximum pain to the greatest number of people The economic cycle (recession) is bigger than you are Fundamentals are no match for forced selling Stocks still go down despite good fundamentals They go down more when there are bad fundamentals The bottom will happen when you stop asking June 6, 2009

- 17. Will Digital Continue to Outperform? Reasons cited for digital to outperform: Efficient spend Measured results Ability to target Free space Budgeting process: ability to back out Key risks to digital outperformance thesis: Cyclical forces stronger than secular shift at end of cycle Traditional media has been cut, digital could be next Digital now large enough to be cut back Now approaching 10% of total advertising in U.S. Easy to cut budgets, simply increase ROI hurdles June 6, 2009

- 18. On the (Slow) Decline of Portals… … and the implications for the Internet ecosystem

- 19. Social Media Continues to Grow ….while portals decline… June 6, 2009

- 20. Social Media is fantastic consumer application …but only marginally profitable… June 6, 2009 Source: Clearmeadow, RBC, Comscore All else equal, if a consumer spends an hour daily on Facebook instead of AOL, the Internet ecosystem would miss out on over $600 of annual revenue

- 21. Publishers: Bringing Content to Social Media Syndication Widget-ization Partnerships Behavioral targeting and audience re-targeting June 6, 2009 Unfortunately, all of these approaches require publisher to cede control of monetization, context, and inventory availability

- 22. So what to do about Content Fragmentation? The best defense is a good offense Vertical ad networks make sense as long as there are very tight controls on publisher quality Yield differentials should be massive Plenty to share with partners MTV and Martha Stewart recently started vertical ad networks, using existing sales forces and leveraging media brands to command higher pricing Competitors in the print or television world can be partners in digital We don’t need more ad networks, we just need to apply the best media sales forces to high quality third party inventory “ You can distribute some of our content if we can sell ads on some of your page views” June 6, 2009

- 23. Yahoo: Decline Accelerating Quarterly results: weak, as predicted Search surprisingly strong, display weaker than understood - 10% workforce reduction unfortunately insufficient Savings of $400mm offsets loss of 8% of company ad revenues Yahoo! shares imply only $8 billion for US portal and $17 billion total Microsoft offered $45 billion for whole company! June 6, 2009

- 24. Who else could “save” Yahoo? Yahoo! still has a solid core franchise. When the cycle turns, the company will be able to combine with traditional media company. One could reasonably expect Yahoo’s display ad business to be down 10-15% in 2009 Valuation now invites new potential owners Potential buyers below $20 (Disney, Comcast, News Corp., GE) Conclusion: Down, but not down for the count June 6, 2009

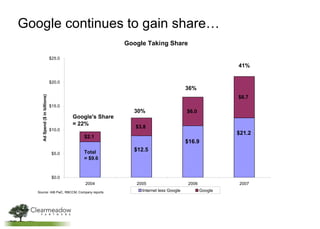

- 26. June 6, 2009 Google continues to gain share…

- 27. Consolidation Will Return Key hurdle is corporate liquidity Most likely to be acquired: MNST, YHOO, VCLK, parts of the IACI group of companies Valuations support action now The stock market will go up in 2009, after bottoming in the first quarter of 2009 June 6, 2009

- 28. Ad networks… enough already Ad networks are sprouting up everywhere Consolidation makes sense strategically and financially In 2007, there was $2 billion of M+A and $300mm+ of VC investment, not counting AQNT and TFSM acquisitions Net margins are generally low, in the 10-15% range, even for fully scaled ad networks The key differentiators include the degrees to which a network focuses on: Targeting Acquiring inventory directly or on a representation basis, and whether on an arbitrage or revenue-sharing basis A particular media type or type of inventory Selling on a CPA, CPC or CPM basis, whether via auction or negotiated A network vs. an exchange June 6, 2009

- 29. … Marketers & Agencies are Increasingly Selective Towards Ad Networks…. 74% use 1 or 2 ad networks in average media plan Two ad networks seems like the magic number (43%) Less than 15% use 3+ per plan June 6, 2009 Source: Collective Media 2008 Survey

- 30. Impact of Ad Networks: Over-Supply Key Finds from Bain/IAB Digital Pricing Research Increased use of networks – representing 30% of sold inventory, up from just 5% in 2006 Average CPM’s on networks of $0.60-$1.10 vs. $10-$20 in direct sold Publisher challenges in managing price and yield Lack of measurement data Lack of resources to optimize CPMs and yield Lack of data on network volumes and pricing June 6, 2009

- 31. Jordan Rohan (917) 699-4220 [email_address]

![What Have I Been Up To? Started Clearmeadow Partners , a digital media advisory firm Firm’s mission: to help companies of all sizes accelerate growth in digital revenue Profitable companies with defensible market positions Advisory services, capital raising, and business development services Want to chat? [email_address] June 6, 2009](https://image.slidesharecdn.com/jordan-rohan-1225731619693690-8/85/Jordan-Rohan-2-320.jpg)

![Jordan Rohan (917) 699-4220 [email_address]](https://image.slidesharecdn.com/jordan-rohan-1225731619693690-8/85/Jordan-Rohan-31-320.jpg)